For every debtor, there is a creditor. If an individual (the debtor) takes out a loan for revolving credit, such as credit cards, or non-revolving credit, such as auto, boat, trailer, mobile home or student loans, the debt obligation is owned by a creditor.

Consumer credit, covers most short and intermediate-term credit extended to individuals including the above listed examples, but excludes residential secured loans such as home mortgages.

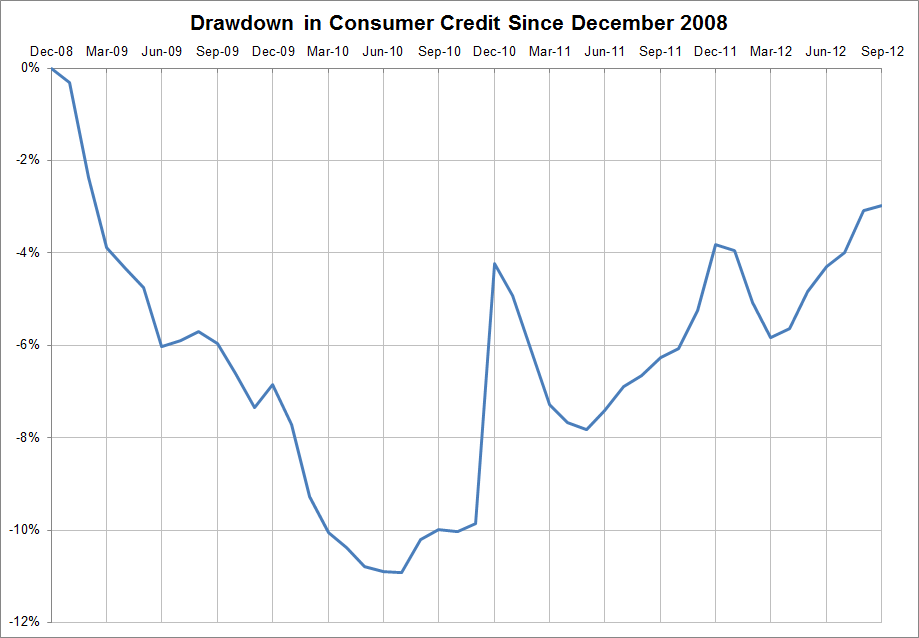

After adjusting for inflation, non-residential secured consumer credit in America reached a peak level of $2.80 trillion during December 2008 and has yet to return to this high water mark. Yesterday, the U.S. Federal Reserve announced that non-residential secured consumer credit in America stood at $2.72 trillion as of the end of September 2012; approximately $80 billion short of the December 2008 record.

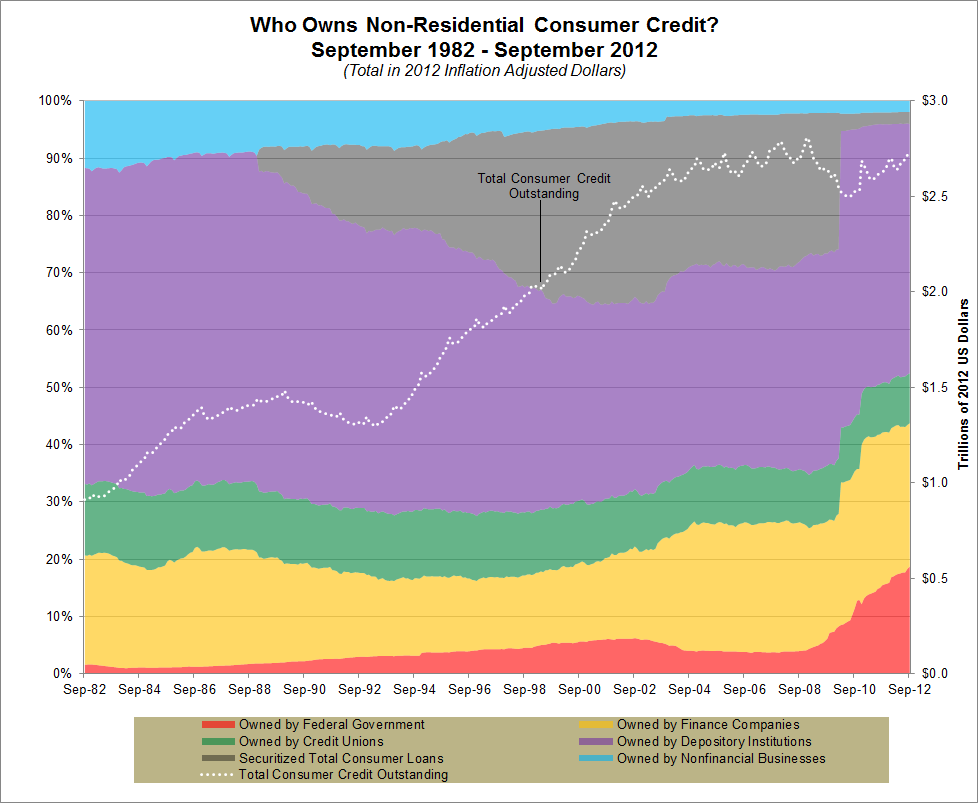

Outstanding consumer credit is held by six major holders.

- The Federal Government

- Finance Companies

- Credit Unions

- Depository Institutions

- Investor Owned Securitized Obligations

- Nonfinancial Businesses

Historically, depository institutions have been the major holder of consumer credit. When securitized consumer credit obligations first appeared in the mid 1980s, financial institutions, such as depository institutions credit unions and finance companies were not considered to own these structured products. However, that changed with the implementation of new accounting rules in 2010 that considered these obligations directly owned by the institutions. The shift of consumer credit from pools of securitized assets to other categories is largely due to the implementation of the FAS 166/167 accounting rules. The sharp decline in securitized obligations during 2010 reflects this rule change.

(click on any image for a large size)

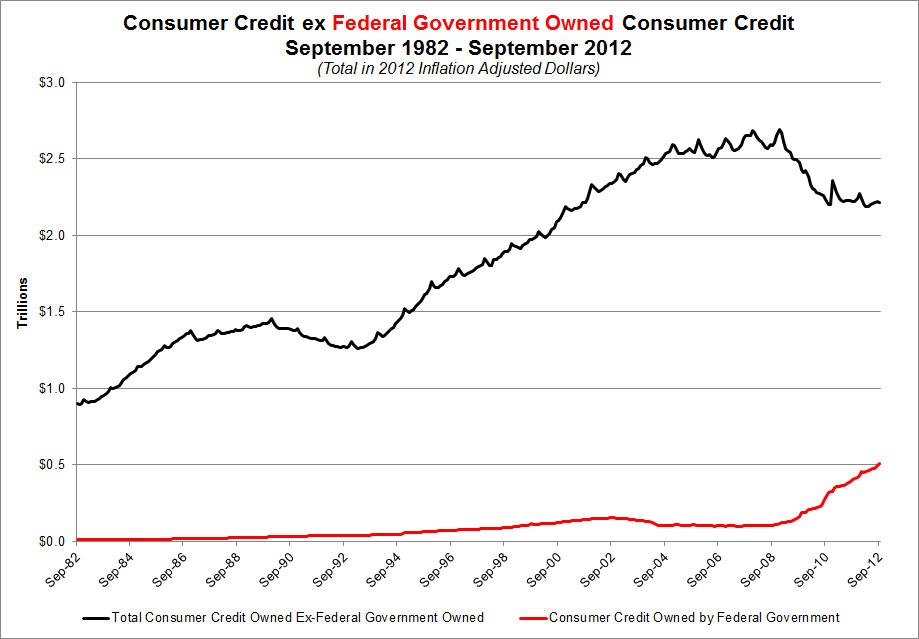

Since 2009 the only area which has seen significant growth in consumer credit outstanding has been the U.S. Federal Government. Consumer loans held by the federal government include student loans originated by the Department of Education and Federal Family Education Loan Program loans that the government purchased from depository institutions and finance companies.

Data Source: U.S. Federal Reserve