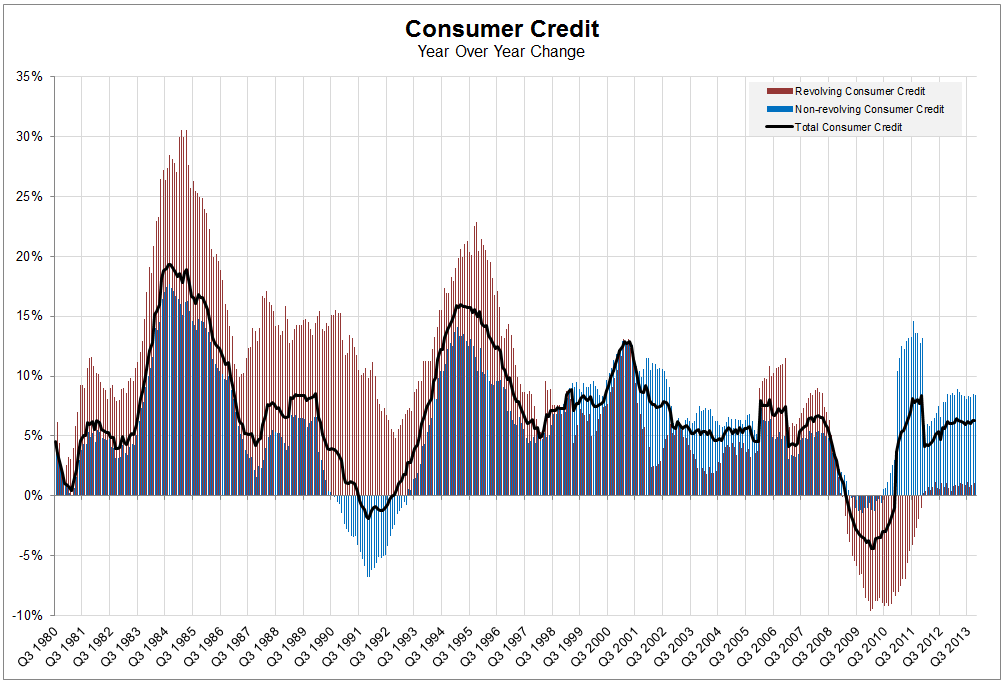

In October non-residential consumer credit grew for the 35th consecutive month in the United States. Of the two types of primary borrowing by consumers, one type is far outpacing the other.

Revolving credit, such as credit cards in which outstanding balances can be increased, has expanded at an unusually low rate. Year over year growth has been no more than 1.1% since the Great Recession.

Non-revolving credit, such as auto and student loans where the outstanding balance is known and paid down, has been the primary driver of consumer credit growth.

Total consumer credit has been expanding close to norms of the past 20 plus year, but it has mostly been due to auto and student loan growth.

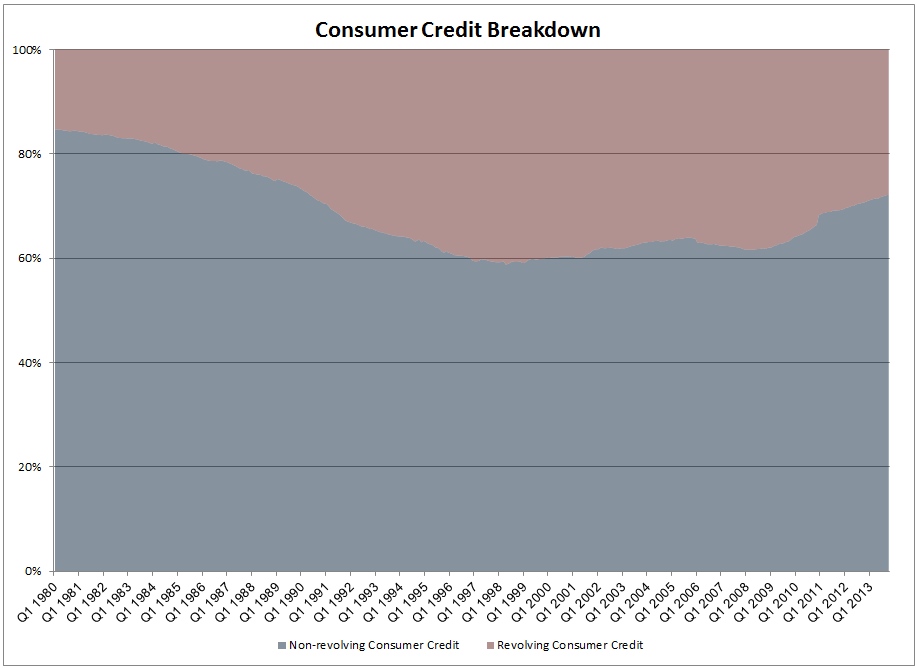

The most recent data continues the ongoing reversion in the composition of total consumer credit. At its peak, in the late 1990s, revolving credit represented over 40% of all credit. It is now down to a level not seen since 1990, 28%.

Data Source: Board of Governors of the Federal Reserve System