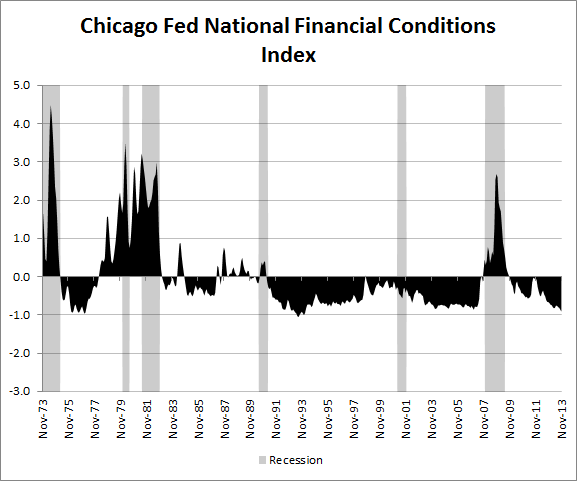

Financial conditions, as measured by the Federal Reserve Bank of Chicago National Financial Conditions Index, have not been this loose since 1994.

The National Financial Conditions Index is made up of three components that measure leverage, risk and liquidity in money markets and debt and equity markets as well as in the traditional and “shadow” banking systems. Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

The only periods that have had looser financial conditions (since 1973) than today are early 1976 to early 1977 and early 1993 to early 1994.

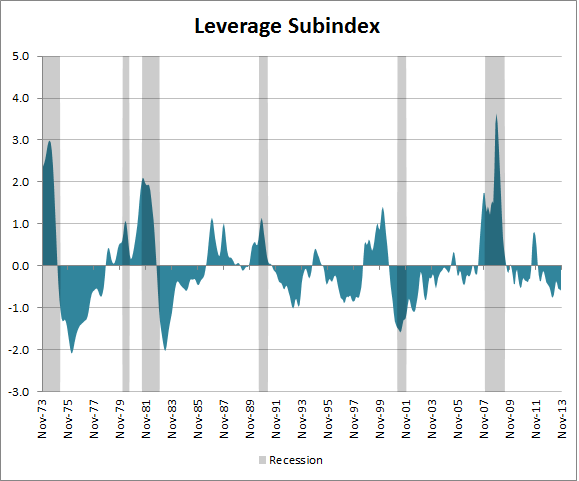

The leverage subindex, debt and equity measures, during the financial crisis of 2008 to 2009 illustrated tighter conditions than at any other point since 1973. Today it is relatively loose, but five other periods since 1973 have had looser conditions.

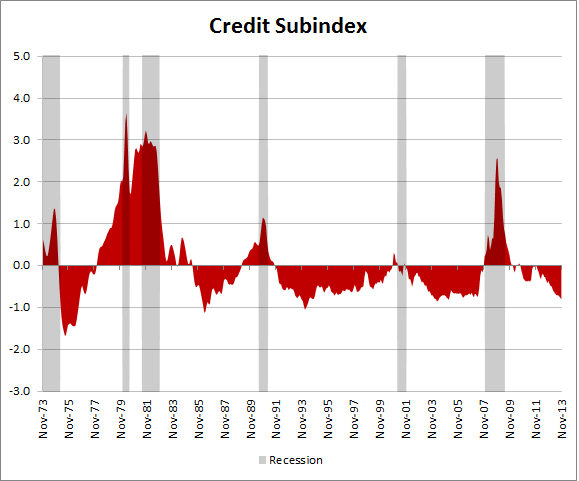

The credit subindex prior to the financial crisis was relatively loose for around fifteen years. Today it is approaching similar levels.

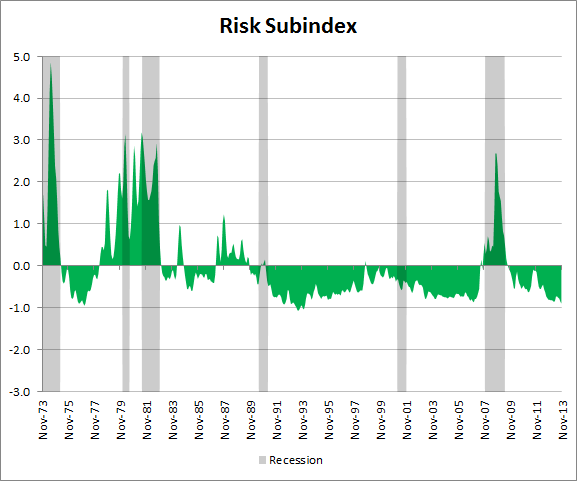

The risk subindex, volatility and funding risk in the financial sector, enjoyed a remarkable run of loose conditions from 1989 to 2007. The risk subindex today is as loose as it has ever been.

Data Source: Federal Reserve Bank of Chicago