Utilizing Robert Shiller’s Stock Market Data, which stretches back to 1871, the frequency of a minimum level of equity return can be determined. Analyzing total returns, price performance plus dividends, over a 10 year period provides a sense of how often an equity investor has experienced a minimum average annual return.

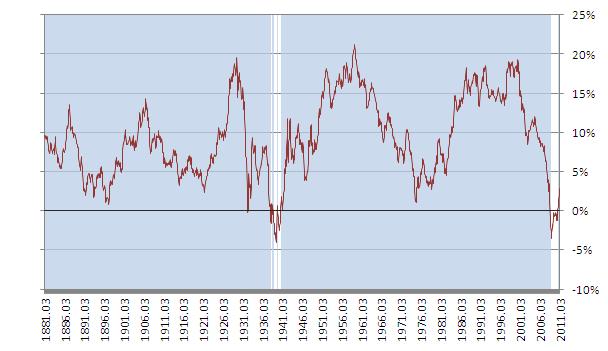

The charts below depict the average annual return over 10 year periods using month end equity pricing from March 1871 to March 2011. The long term average, 10 year average annual return is approximately 9.3%, but as the charts illustrate, 10 year average annual returns have ranged from -4.0% to 21.2%. The median 10 year average annual return, an equal number of periods above and below the median, is 8.7%.

Red Line: 10 year average annual return. Any point on the line represents the 10 year average annual return for the previous 10 years.

Blue Shaded Areas: Time periods where the minimum level of equity return was achieved

The first chart illustrates that the only time periods, since 1871, in which the 10 year average annual equity return was negative was in the late 1930s/early 1940s and late 2008/2009.

Minimum 0%, 10 year average annual return

(96.7% frequency)

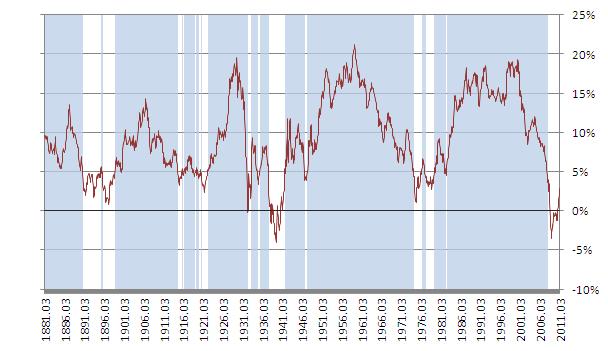

A 10 year average annual return of at least 5% is less frequent of course, but has still happened more often than not.

Minimum 5%, 10 year average annual return

(78.7% frequency)

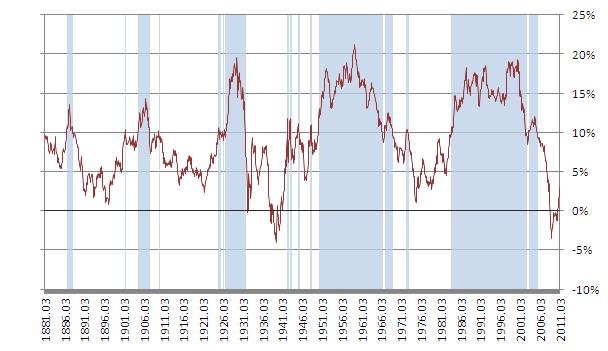

A 10 year average annual return of at least 10% is above the long term average of 9.3% and median of 8.7%. The chart below demonstrates that a minimum 10%, 10 year average annual return was achieved during the 1950s, 1960s, 1980s and 1990s as well as just prior to the Great Depression, the Panic of 1907 and . The two most recent periods represent two long term secular bull markets in U.S. equity.

Minimum 10%, 10 year average annual return

(38.7% frequency)

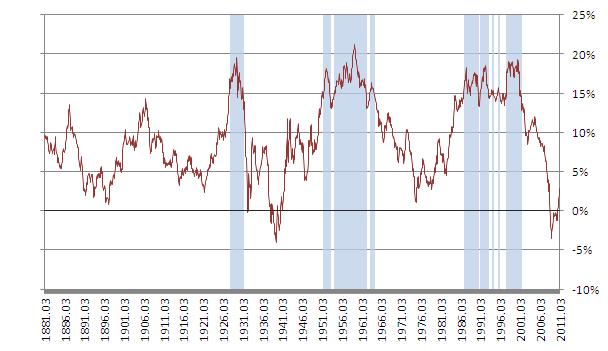

The aforementioned secular bull markets were so strong that the 10 year average annual return was 15% or greater for long periods of time.

Minimum 15%, 10 year average annual return

(18.0% frequency)