Starting with the recession that began during the fourth quarter of 2007 the United States has struggled to reach it’s full economic potential. Even after the economy stopped contracting two years ago the rate of growth has been tepid.

So what is the economic potential of the United States and what would it mean for the economy to run at it’s full potential? The non-partisan Congressional Budget Office (CBO) helps answers these questions by calculating the potential economic output of the United States.

From the CBO. “Although potential output measures the productive capacity of the economy, it is not a technical ceiling on output that cannot be exceeded. Rather, it is a measure of sustainable output, in which the intensity of resource use is neither adding to nor subtracting from inflationary pressure. If actual output exceeds its potential level, then constraints on capacity begin to bind, restraining further growth and contributing to inflationary pressure. If output falls below potential, then resources are lying idle and inflation tends to fall.”

In essence potential output estimates what gross domestic product (total economic output) is possible if the economy was operating at a high rate of resource use and the only unemployment was due to voluntary job turnover. When compared to actual output it can be used to asses current economic conditions, gauge inflationary pressure and project economic growth.

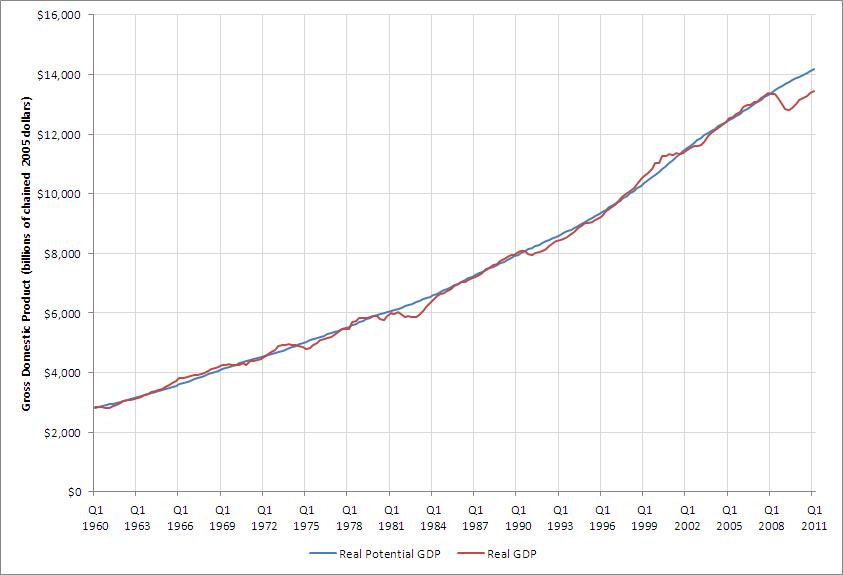

The chart below illustrates that actual GDP, adjusted for inflation and in constant dollars in order to fairly compare different periods of time, has both exceeded and fallen short of potential GDP over the past 50 years. Large, negative output gaps persisted after recessions in the early 1980s and early 1990s, but do not compare with the magnitude and duration of today’s gap. Today’s large gap indicates that a significant amount of resourses are lying idle. Though total industry capacity utilization currently stands at 76.7% after plummeting to 67.5% in early 2009, it remains below the long term average (80%+) of a normal economic expansion.

How this gap is closed is the subject of intense debate. If one believes that the economy suffers from a lack of demand, then fiscal stimulus and a loose monetary policy would be prescribed to temporarily increase total demand while private demand slumps. This strategy of temporarily boosting demand is part of the Keynesian doctrine. If one believes that the economy is hampered by barriers (namely taxes and regulation) then the preferred way to drive economic growth is to reduce taxes and repeal burdensome regulation.