On July 12, 2007, near the peak of the last business cycle, the 10-Year U.S. Treasury note traded with a yield of 5.25%. Yesterday the 10-Year note traded with a near record low yield of 1.48%. (The all time record was, in fact, set just this year on June 1 at 1.44%).

Two questions often asked regarding interest rates include, “how far can interest rates possibly fall” and “how long can interest rates stay so low?”

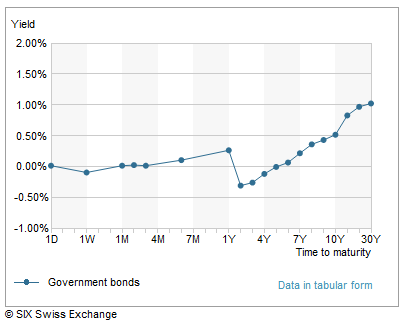

Regarding the first question, a rate of zero sets a reasonable floor for interest rates, however four European nations recently issued short term bills with negative yields. This month, France issued six month bills yielding an average of -0.006% and Germany auctioned six month bills yielding an average of -0.0344%. Earlier in the year, the central banks of both Denmark and Switzerland we able to issue short term government debt with a negative yield. Today the Swiss 2 year note is trading to yield -0.402%. In all instances demand is high enough that investors are willing to purchase short term government debt issued by these nations knowing that, if they hold the security to maturity, they will lose money on the investment. Furthermore, if there is any amount of inflation over the time period, the real return from the investment would be even less.

The Swiss Yield Curve

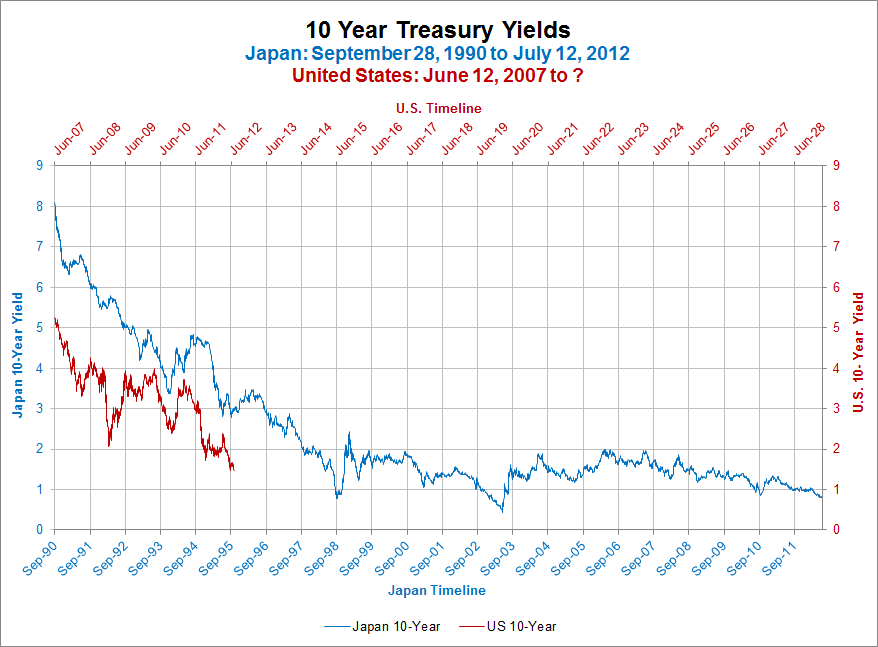

On the matter of “how long can interest rates stay so low” Japan provides an example, perhaps in extremis. The experience in Japan has been one of persistently low interest rates. The chart below illustrates the fact that since March 1999 the Japanese 10-year government note has not yielded more than 2.0% for over 13 years. After the 10-year fell from over 8.0% in 1990 to less than 2.0% eight years later, rates have remained low.

Click on the chart below for a larger view

While the two questions above cannot be answered definitively, examples of extremely low (even negative) interest rates and periods of perpetual low rates have occurred in recent history.

The yield of any (non-inflation adjusted) government bond is primarily a function of future economic growth expectations, inflation forecasts and the degree of safety relative to other securities. Both fiscal (political) and monetary (central bank) policy can be used in an attempt to create either expansionary or contractionary conditions in order to influence future growth and inflation expectations.