During the Great Recession, total consumer credit outstanding declined dramatically for the first time since the early 1990s. Consumer credit, covers most short and intermediate-term credit extended to individuals, excluding loans secured by real estate. This type of credit includes both revolving credit, such as credit cards, and non-revolving credit, such as auto, boat, trailer, mobile home and student loans.

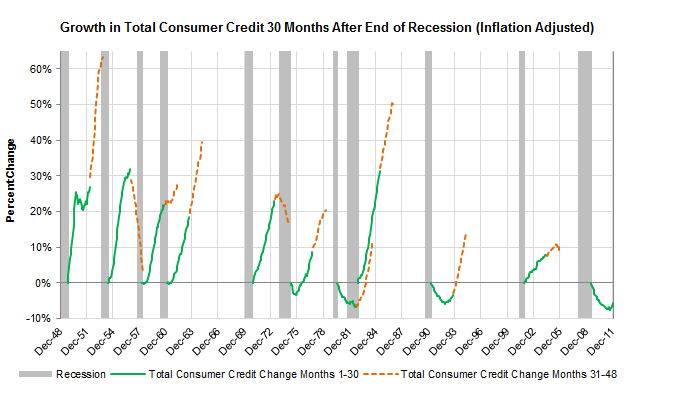

At the outset of recessions consumers typically scale back the amount of credit they carry either deliberately or by defaulting. As the economy recovers people collectively have tended to increase the total amount of credit they carry. In the first chart below, the growth in the amount of credit, from the level of credit observed at the end of the recession, is illustrated.

As of the end of 2011, the economy of the United States has been out of recession for 2.5 years (30 months as depicted in the first chart). Usually thirty months post-recession the total amount of consumer credit has expanded beyond the level at the end of the recession. In fact, total consumer credit expanded in 8 out of the previous 10 instances, prior to the Great Recession. The two exceptions were the economic recoveries of 1981 and 1991. During the early 1980s, the economy slipped back into recession, but in the early 1990s the economy was able to avoid a double dip recession and credit eventually expanded.

If the post recessionary period is extended from 30 months to 48 months total consumer credit has not failed to reach the level of the month immediately following the end of the recession. In order for this not to occur this time total consumer credit would have to reach June 2009 levels by June 2014.

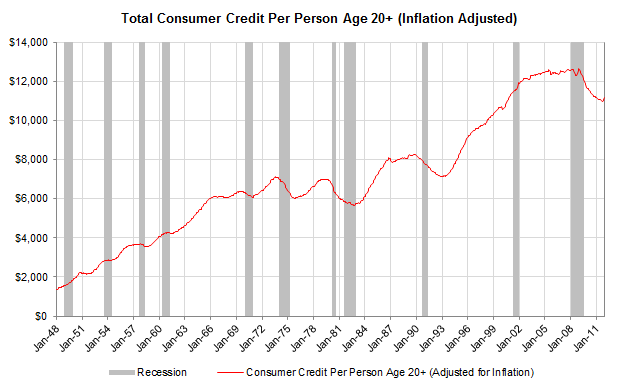

The total amount of consumer credit outstanding at the beginning of the observation period (1948-2011) was dramatically lower than today. In order to determine the average amount of consumer credit per person only civilians that are not institutionalized and at least 20 years or older are assumed to have credit. All individuals that meet this criteria are included regardless of whether they have outstanding consumer loans or not.

After adjusting for inflation, at the beginning of 1948 the average person had $1,344 of consumer debt. (All dollar amounts in the per person calculations are in today’s dollars to account for inflation). The amount of consumer debt steadily increased until the recession of 1970 when the average amount of consumer credit outstanding was $6,303. After only marginally expanding for a decade, during July 1980, the average amount of consumer credit per person permanently increased beyond the previous, January 1970, peak.

During the period known as the Great Moderation (roughly the mid 1980s until the middle part of the 2000s) the amount of credit per person expanded almost without fail. The only time in which credit decreased was during and immediately after the early 1990s recession.

Since the depth of the most recent recession, September 2008, the amount of consumer credit outstanding per person decreased for 33 straight months. During June 2011 consumer credit finally expanded, but it was not until November that the expansion was significant.

The decrease in the total amount of consumer credit outstanding is likely a function of a multitude of factors. A few of which might be increased defaults, individuals choosing to carry less debt and demographics. As many individuals in the baby boom generation have either retired or plan on retiring in the next decade many may be choosing to carry less debt than they did during the middle of their working careers during the 1980s and 1990s.

The total amount of consumer credit in the economy is important because personal private consumption accounts for well over 70% of American gross domestic product. Consumer credit allows people to leverage the amount of assets they have and spend additional amounts. The trend of consumer credit in the U.S. will be well worth watching as the decade progresses.