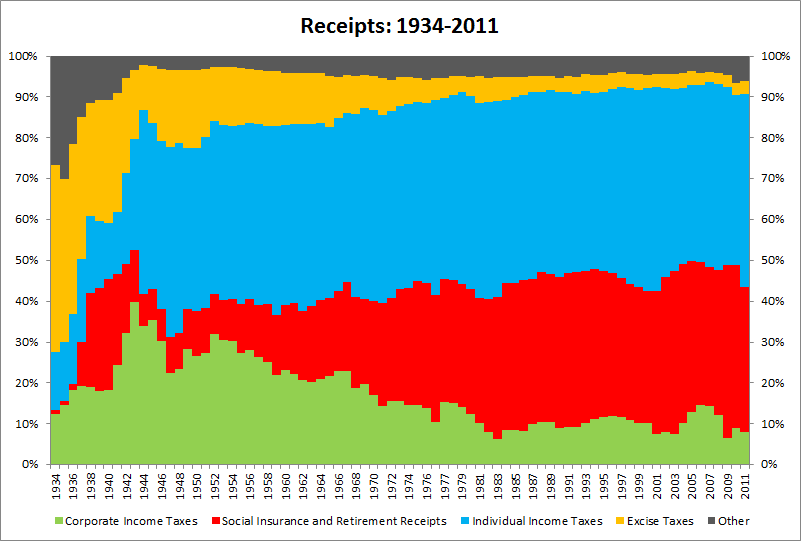

The source of U.S. federal government tax receipts has changed dramatically over the past eight decades.

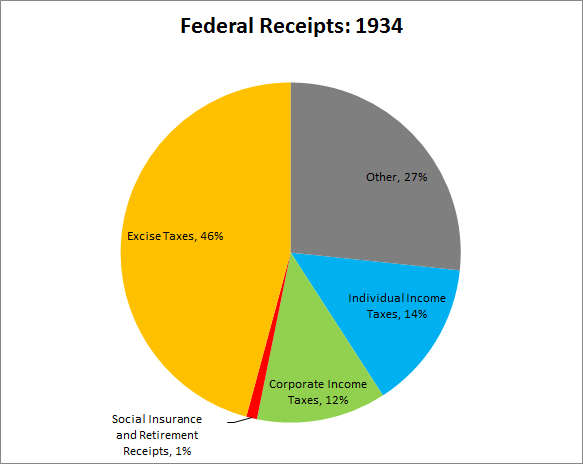

In 1934 nearly half of federal receipts collected were from excise taxes (taxes on items such as gasoline and alcohol). Over a quarter came from “other” taxes such as taxes on customs, duties and fees, gifts and estates. Only 1% came from social insurance and retirement receipts.

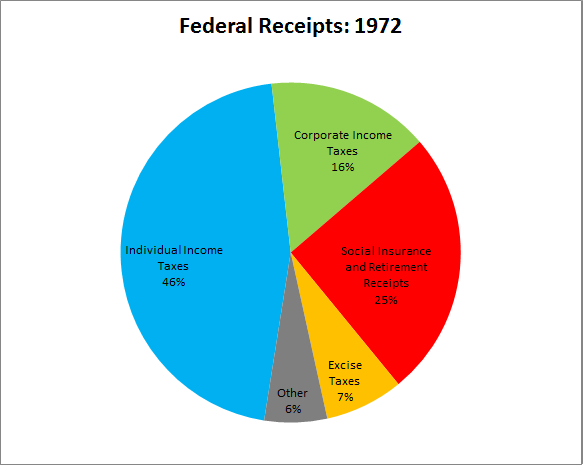

Thirty-eight years latter the federal tax receipts picture looked much closer to today then it did in 1934.

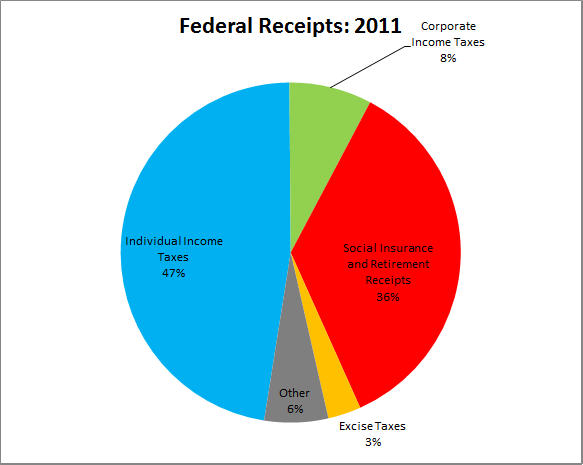

Last year nearly half of all federal government receipts came from individual income taxes and a quarter came from social insurance and retirement receipts. Over 90% of social insurance and retirement receipts are for Social Security and Medicare.

Over the past 77 years federal tax receipts morphed from a system relying heavily on excise taxes to, today, coming mainly from individual income taxes and social insurance and retirement receipts. The only years that corporate tax receipts made up a lower percentage of total taxes collected than 2011 was 1983, 2001, 2003 and 2009. Each year the economy was either in a recession or had only come out of the recession a year earlier.