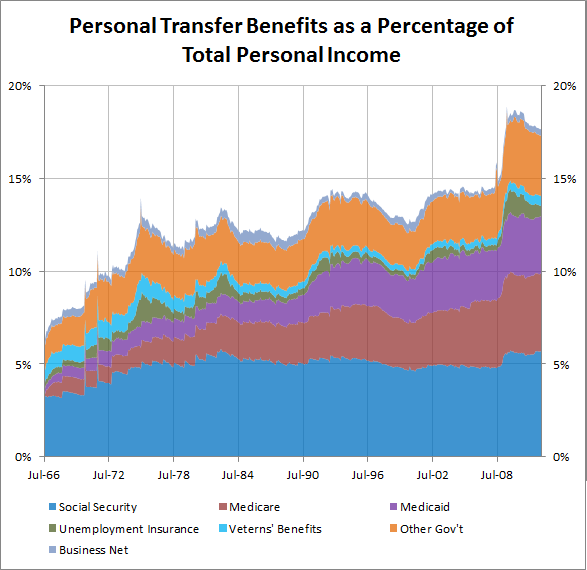

The source of American household income has changed dramatically over the past half century.

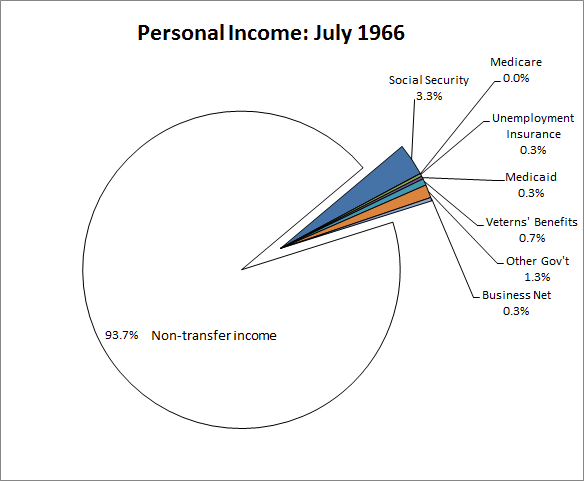

In 1966, 93.7% of all personal income in America came from wages, interest and business owner income. Just under 6% was from government transfer programs (Social Security, Medicare, unemployment insurance, Medicaid, veterans’ benefits, and other government programs). The final 0.3% of income came from net business transfer payments, primarily personal-injury liability payments to individuals other than employees. (Here is how American’s Spend Their Income How Americans Spend Their Money)

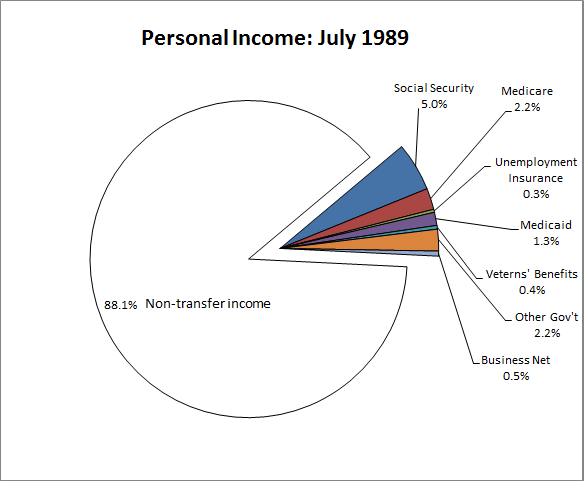

Twenty three years later, the amount in household income that came from non-transfer programs had fallen to 88.1% while government transfer programs accounted for 11.4% of total American income.

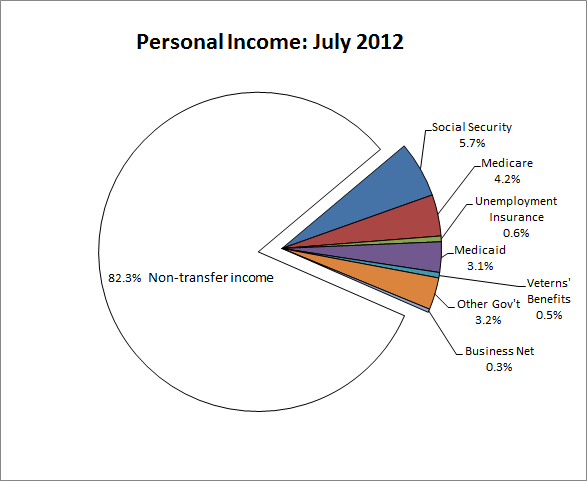

Today, only 82.3% of American household income comes from wages, interest and business owner income. Fully 17.3% of income comes from government transfer programs. The “big three” programs, Social Security, Medicare and Medicaid, alone account for 13.0% of all income received by Americans.

Over time, government program transfer programs have become a larger source of where Americans derive their income. With the baby boom generation entering the age at which Social Security and Medicare can be drawn, this long term trend is not expected to reverse – see Yesterday, Today and Tomorrow: The Aging of America. In addition medical cost inflation has been higher than any other major goods or service category – see The Rise and Fall of Consumer Prices Over Time.

Data Source: U.S. Bureau of Economic Analysis