The impact of rising interest rates over the past few months affects savers, borrowers and investors. The question for savers is, will there be future inflation what will eat into the the higher yields offered today? If not the real yield (nominal yield minus inflation) will improve. Despite the fact that inflation has been very low for many years now, rates have been even lower resulting in a negative real yield for many savers. For borrowers, higher interest rates will mean a larger portion of their debt payment will go towards interest payments and might mean that they are able to borrow less. For investors, the positioning of their fixed income portfolio will determine how quickly dividends and bond maturities are able to be reinvested at today’s higher rates.

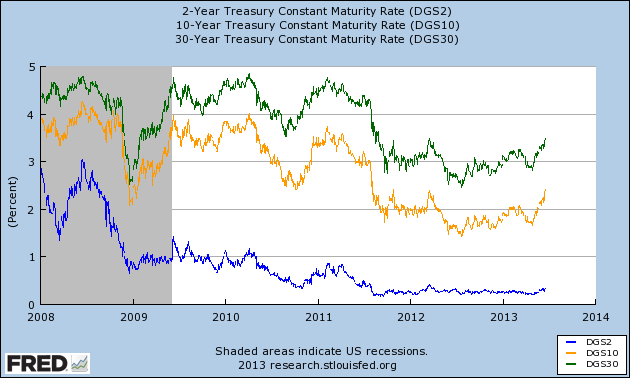

Over the past two months interest rates in the United States have generally moved higher. The increase has been more pronounced for longer term maturities than shorter term maturities. The first chart below illustrates that the last time there was such a sharp move was during the second half of 2010. When this occurred, three years ago, short term rates moved higher along with longer term rates.

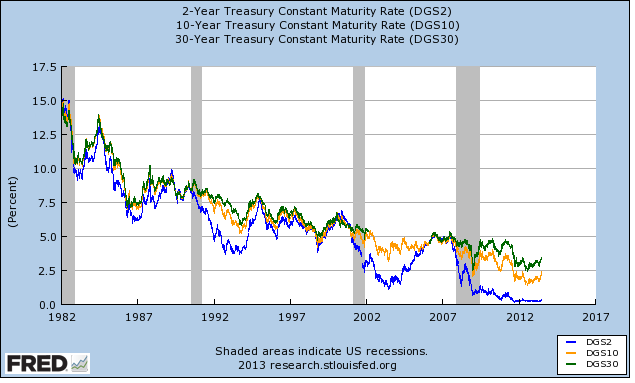

A longer look at interest rates depicts the fact that though rates have increased over the past seven weeks, they remain extremely low relative to any point over the past 31 years.

Today, the difference between the rate of short term bonds and long term bonds remains historically wide. This large spread continues to persist as short term rates have refused to moved higher as quickly as longer term rates.