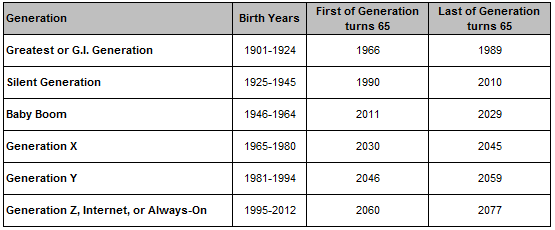

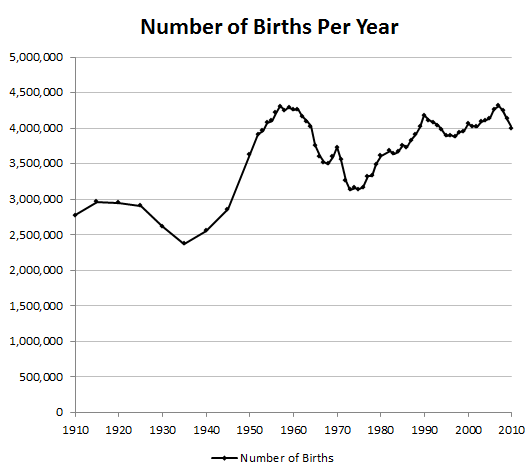

As the front end of the baby boom generation has begun to retire, there has been a lot of press about the impact that this generation will have over the next three decades on everything from the economy to politics to investments.

When individuals reach their retirement years, their spending and investing habits typically change. For most, the accumulation of assets phase, defined by years of employment income, ends. Financial assets accumulated over a lifetime are usually spent down rather than added to, on a net basis.

Consumption habits of those age 65 or older are different then they are for younger generations as the days of child care costs are likely over, and the amount of debt on housing and in other forms is less than it was earlier in life.

As far as investments are concerned, boomers, as they reach their retirement years, may prefer to hold a greater percentage of relatively safer assets and fewer assets that they perceive as risky, than they did during their working years.

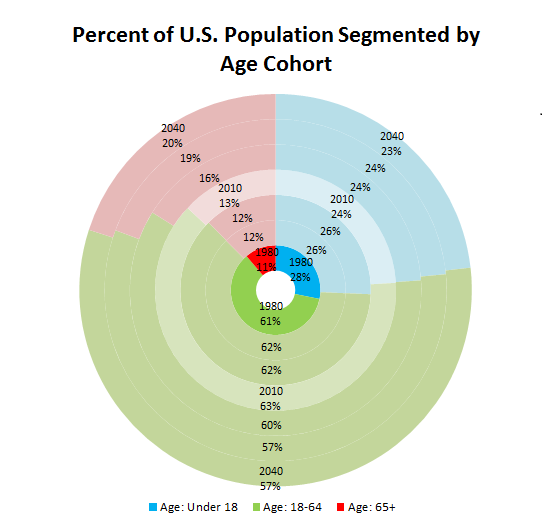

The impact that the baby boom generation will have on the next thirty years will be more profound then the impact that previous cohorts of people age 65 or higher had. This is due to the sheer number of boomers that there are relative to the rest of the population. In 1980 when the Greatest Generation was reaching age 65, only 11% of Americans were over the age of 65. Today, 13% of the U.S. population is at least 65 years of age. This figure is projected to jump to 19% by 2030 when even the youngest of the baby boom generation will be 65.