The duel mandate of the U.S. Federal Reserve is to “promote effectively the goals of maximum employment and stable prices.” When the Great Recession of 2008-2009 began in the United States the Fed lowered the Fed fund rate to near zero and over the past five years implemented numerous bond buying programs in an attempt to stimulate economic growth which would likely maximize employment and stabilize prices.

The Fed was established by an act of Congress in 1913. Over these 100 years there have been a number of economic conditions. Two of the sharper economic downturns during this period include the Great Depression (a combination of two severe recessions in the 1930’s) and the Great Recession of 2008-2009.

With this as background it is an interesting exercise to compare employment and consumer prices during the Great Depression and Great Recession.

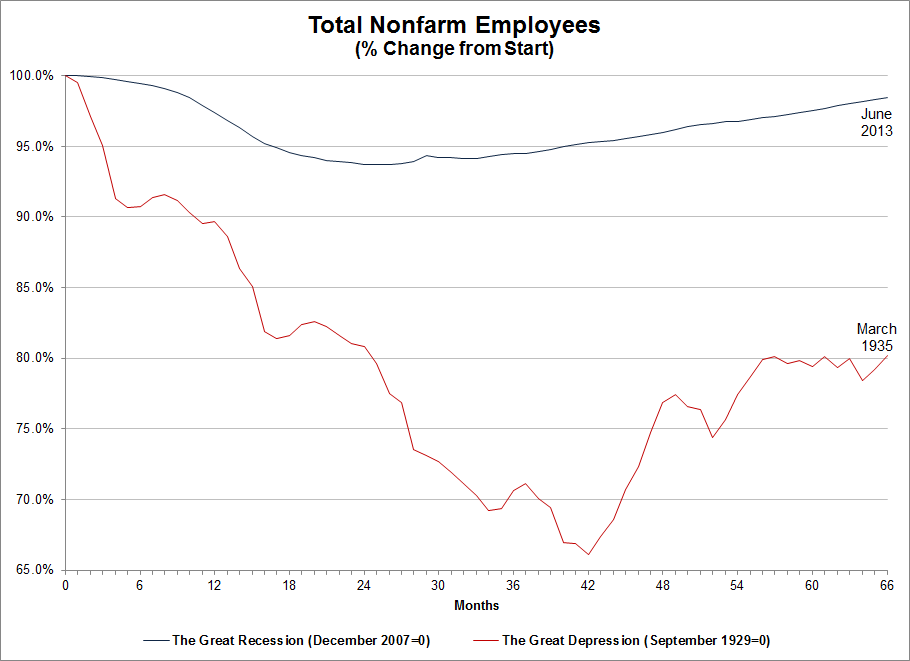

Employment

- The Great Recession

- The number of people employed as a percentage of people that were employed just prior to the recession in December 2007 fell to 93.7% by the end of 2009.

- 66 months after the start of the Great Recession, June 2013, the percentage is 98.4%. This means that there are less people employed today than there were at the start of the recession.

- The Great Depression

- The number of people employed as a percentage of people that were employed just prior to the start of the Great Depression in September 1929 fell to 66.1% by the beginning of 1933.

- 66 months after the start of the Great Depression, March 1935, the percentage was 80.2%. This means that there were still significantly less people employed than there were prior to the Great Depression.

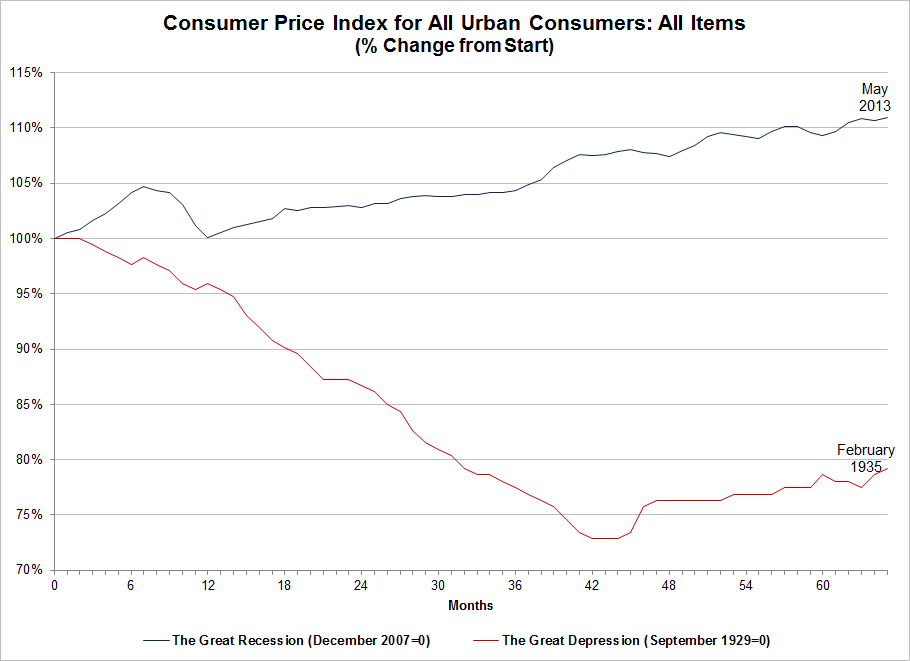

Consumer Prices (Inflation/Deflation)

- The Great Recession

- Consumer prices rose for the first seven months of the recession before falling for the rest of 2008.

- 65 months after the start of the Great Recession, May 2013, consumer prices are 10.9% higher than they were before the start of the Great Recession; by historical standards relatively low inflation.

- The Great Depression

- Consumer prices began falling immediately upon the outset of the Great Depression and had fallen by over 27% by early 1933.

- 65 months after the start of the Great Depression, February 1935, consumer prices were still nearly 21% lower than they were before the start of the Great Depression. A severe episode of deflation.