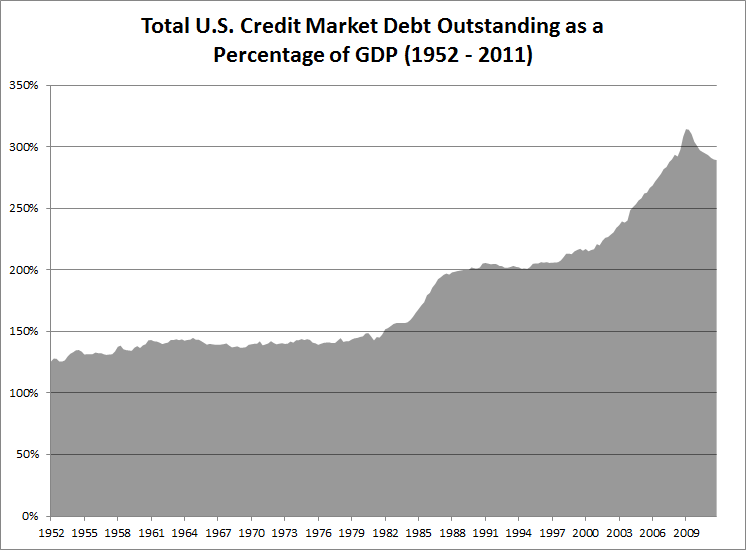

One way to describe the cause of the Great Recession of 2007-2009 was a popping of a credit bubble.

The great credit boom in the U.S., that came to a halt during the latter part of the past decade, has its roots in the early 1980s. Following a double dip recession in 1980 and 1982, the U.S. economy began to expand. Double digit interest rates and inflation subsided and interest rates would begin a slow, secular decline that would span over three decades. While the economy grew in the middle part of the ’80s, all sectors of credit market, both private and public, increased their debt load.

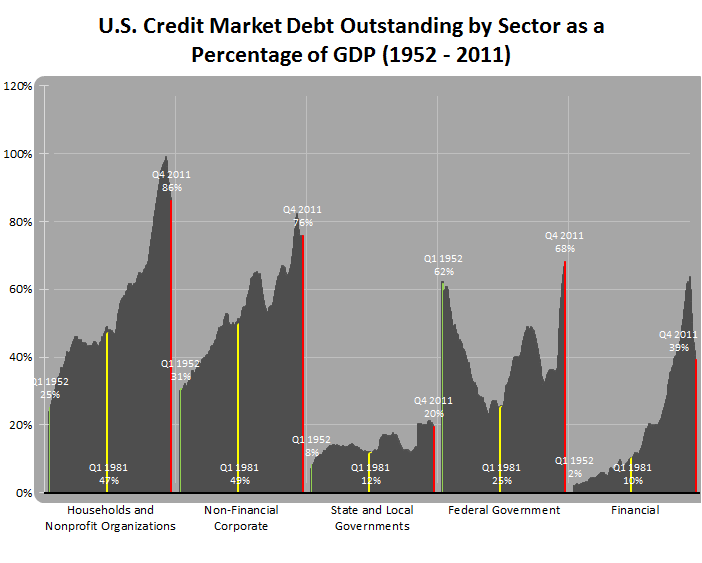

The great expansion in credit took a pause in the late 1980s and early ’90s as the U.S. suffered through a savings and loans crisis, followed by a recession. By the mid ’90s, however, the second leg of the credit boom took hold and credit expanded further, this time for a prolonged period of time. Consumers, corporations and financial institutions all took on more debt as the ’90s progressed. Even as the recession of 2001 hit, the only private sector to see a reduction in its credit to GDP ratio was non-financial corporations.

By the fourth quarter of 2007, just prior to the U.S heading into recession, household debt stood at 97% of GDP, non-financial corporate debt was 75%, financial institution debt 62%, state and local government debt 20% and federal government debt 36%. As the economy shrunk, all of these percentages rose as GDP contracted. Total U.S. credit market debt eventually peaked at 309% of GDP during the first quarter of 2009.

As of the end of last year, each segment of the credit market has seen a decline in the amount of debt relative to GDP, except the federal government. The financial sector has contracted the most on a relative and absolute basis. By the end of 2011, the size of the total U.S. credit market relative to GDP declined to 289%. Interestingly, this is the same level as it was just prior to the Great Recession.

Data Source: Federal Reserve

Note: U.S. government agency securities, government sponsored enterprise (GSE), debt is not included in the total. GSE debt includes Fannie Mae, FHLB, Freddie Mac, Farm Credit System, Sallie Mae, REFCORP, FICO and Farm Credit System. The majority of GSE debt is in the form of home mortgages and student loans. This debt is owed by households and non-financial corporations and, therefore already captured.