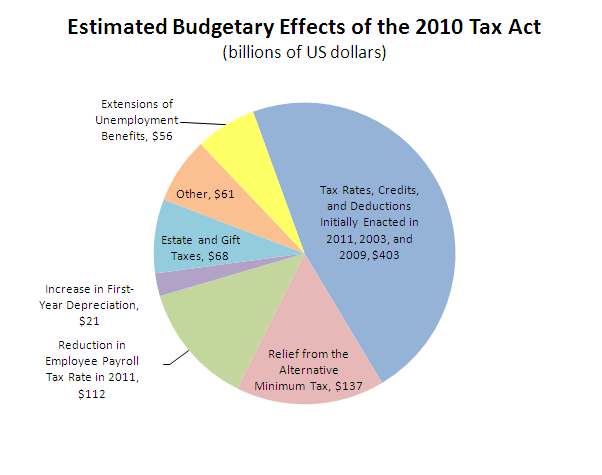

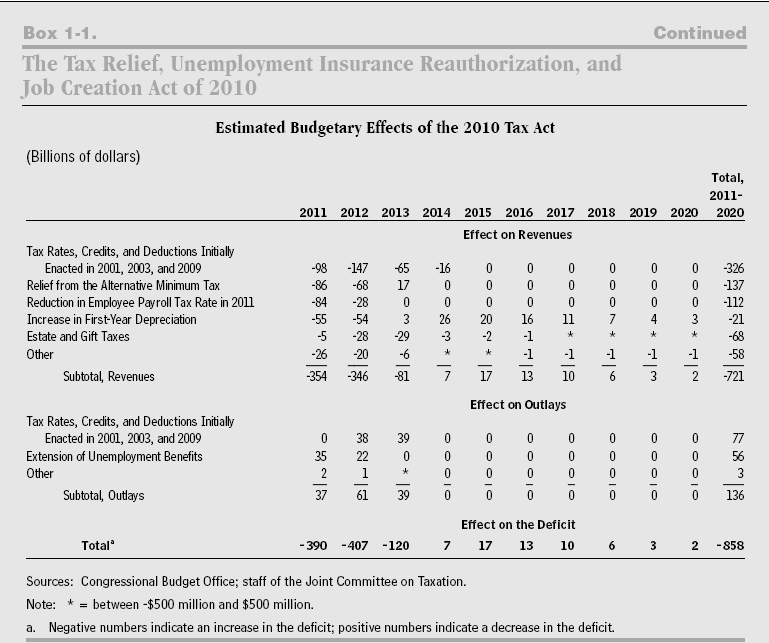

As part of its Budget and Economic Outlook: Fiscal Years 2011 through 2012 report, the Congressional Budget Office (CBO), a nonpartisan federal agency within the legislative branch, has released the estimated budgetary effects of the 2010 Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. “The CBO estimates that the act will increase the deficit by $390 billion in 2011, by $407 billion in 2012, and by $120 billion in 2013, and that it will reduce deficits by $59 billion between 2014 and 2020,” a total net addition to the deficit of $858 billion over the next ten years..

The 2010 Tax Relief Act extends several provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001, the Jobs and Growth Tax Relief Reconciliation Act of 2003, and the American Recovery and Reinvestment Act of 2009, which will increase the deficit by $403 billion between 2011 and 2014.

- Retaining the 10, 25, 28, 33 and 35 percent tax brackets that would have otherwise reverted back to 15, 28,31, 36 and 39.6 percent respectively

- Continuing the 15 percent top tax rate on long-term realized capital gains and dividends that otherwise would have reverted to 20 percent for capital gains and 39.6 percent for dividends

- Postponing the phase-out of itemized deductions and personal exemptions for higher income taxpayers

- Maintaining the $1,000 tax credit per child instead of dropping it to $500 and expanding the availability of the credit to taxpayers without tax liability

- An expansion of the earned income tax credit for certain post-secondary education expenses

- An expanded 15 percent tax bracket and standard deduction for married couples, which was set to contract to less than twice the deduction for single taxpayers

.

The 2001 Act, from above, was set to let the estate tax return to a maximum of 55% with an exemption of $1 million on January 1, 2011. The 2010 Tax Relief Act has set the rates and exemption amounts for 2011 and 2012 at 35% and $5 million. This according to the CBO will lower revenues by $68 billion over the period from 2011 to 2020. This new rate and exemption amount will expire on December 31, 2012.

Other extensions that will add to the deficit include:

- Extension of the AMT patch, a $154 billion hit to revenue from 2011 to 2012 before adding $17 billion to revenues in 2013

- Reducing the employee’s Social Security Tax from 6.2% to 4.2% which will result in a reduction of revenues of $112 billion from 2011-2012

- Ability for businesses to increase first-year depreciation in 2011. This provision will come at a net cost of $21 billion

- Extension of emergency unemployment benefits. This will increase outlays by $56 billion through 2012

.

Click image for CBO table