Europe faces stark choices. As interest rates rise in Greece, Ireland, Portugal, Spain, and now Italy, the 17 nations in the Eurozone that share the common Euro currency and the 27 countries that comprise the wider European Union must collectively decide to what extent they are willing to lend to nations that can no longer afford to finance their deficits at the high rates that the market demands. The conditions of these loans, namely cuts in government spending, must also be determined. In addition to loans, the direction of monetary policy from the European Central Bank will determine how the Eurozone will emerge from the current crisis.

The questions that arise from the current plan to lend to distressed Eurozone nations include, will the pool of committed loans be enough to carry the troubled European nations through their current funding difficulties and how tight or expansionary will monetary policy be by the European Central Bank?

To date, the following programs have been established to lend to Euro countries that request and are approved for loans.

- The European Financial Stability Facility (EFSF) was agreed upon and established during May 2010 and expanded in October 2011 and is able to lend up to €440 billion.

- The €60 billion European Financial Stabilization Mechanism (EFSM) was established during May 2010.

- Up to €250 billion from the International Monetary Fund (IMF) is available.

- Total lending power of €750 billion from the EFSF, EFSM and IMF.

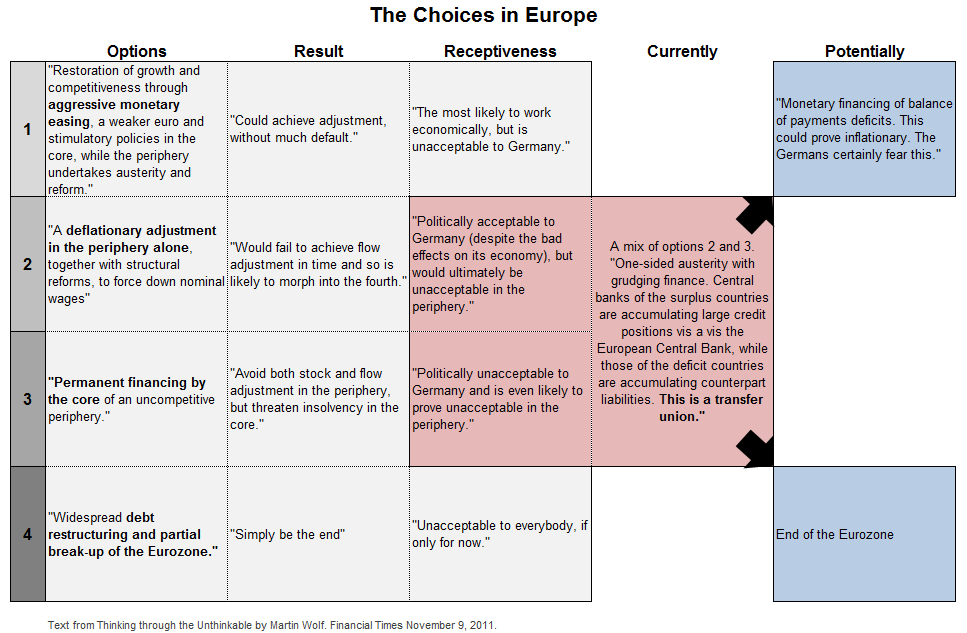

In his most recent Financial Times column, “Thinking Through the Unthinkable“, Martin Wolf reviews the four options that economist Nouriel Roubini believes are currently available to European leaders. The table below outlines these choices as described by Wolf in his column.

Click on the table for a larger image