At the end of last week the United States Federal Reserve announced it’s intention to purchase “agency mortgage-backed securities at a pace of $40 billion per month.” This marked the third quantitative easing (QE) action taken by the Fed since the throes of financial crisis during the final months of 2008. Unlike the first two QE programs, which both had finite lives, this time there is no defined total amount.

Why has the Fed decided to introduce yet another QE program?

The Federal Reserve’s mission helps answer this question. (emphasis added)

The Federal Reserve System is the central bank of the United States. It was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. Over the years, its role in banking and the economy has expanded.

Today, the Federal Reserve’s duties fall into four general areas:

- conducting the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates

- supervising and regulating banking institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers

- maintaining the stability of the financial system and containing systemic risk that may arise in financial markets

- providing financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation’s payments system

Pursuing maximum employment and stable prices is often times refered to as the Fed’s dual mandate. These two directives are in place in order to promote a stable financial environment where long run economic potential is achievable.

Typically the Fed uses its primary tools of setting the bank reserve requirements, changing the discount interest rate or adjusting the federal funds rate to conduct monetary policy. It will tighten policy if economic conditions become too hot (i.e. high inflation) or loosen them if economic conditions are too cool (i.e. low inflation or deflation and/or high unemployment).

When the economy began to slow in late 2007 the Fed began to lower the discount rate and federal funds rates. These cuts in interest rates were not enough to encourage further financial activity and the Fed cut rates to essentially zero by the end of 2008.

With unemployment continuing to rise and deflation looming, the Fed felt it needed to do more to support the financial system and stabilize the monetary environment.

The first extraordinary quantitative easing program (QE1) was announced on November 25, 2008 with the Fed promising to purchase $500 billion in Mortgage Backed Securities (MBS) and $100 Billion of direct government sponsored entity (GSE) obligations – i.e. mortgages from Fannie Mae and Freddie Mac.

QE1 was expanded March 2009 with the Fed stating that it would buy an additional $750 billion of MBS, and up to $300 billion of long -term U.S. Treasury securities. QE 1 came to an end at the end of the first quarter 2010.

Not satisfied that it had done enough to lower unemployment and provide price stability the Federal Reserve announced a second quantatative easing effort November 3, 2010 (QE2). The Fed stated that it would buy an additional $600 billion of U.S. Treasuries under this program. By June 30, 2011 the Fed completed its task.

Less than three months later the Fed announced that it would sell short term U.S. Tresuries and use the procedes to purchase long term U.S. Treasuries. This became known as Operation Twist, as the intention was to lower longer term yields. By selling short term securities, yields would rise on the short end of the yield curve. Hence, the yield curve would undergo a twist.

Last Thursday, the Federal Reserve declared that it felt that further extraordinary monetary easing was necessary to fulfill its mission – promote full employment and long term price stability. Ben Bernanke announced that not only would Operation Twist continue, but that the Fed would purchase $40 billion of mortgage-backed securities per month for as long as the Fed felt it was necessary. Unlike QE 1 and QE 2 which both had finite timelines, QE 3 does not.

To answer the original question posed, Why has the Fed decided to introduce yet another QE program?

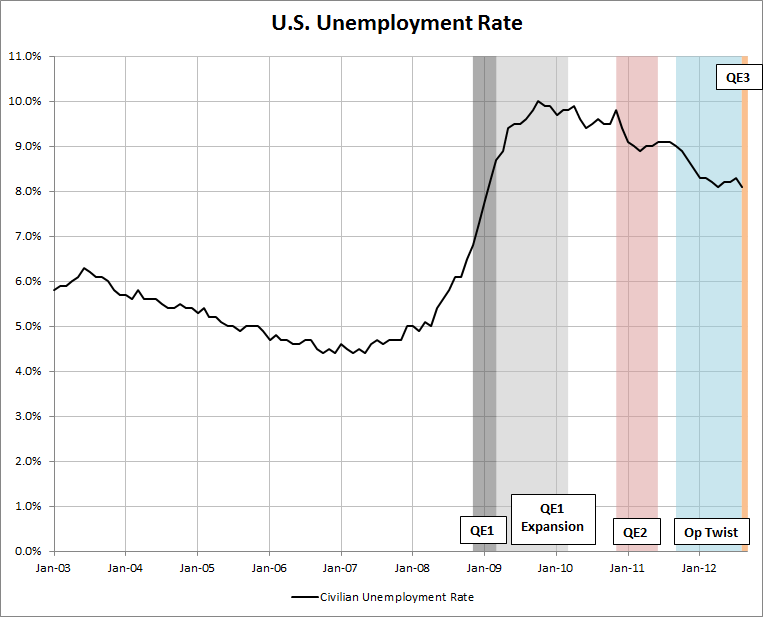

1. The unemployment rate is still quite high and certainly above the long term average.

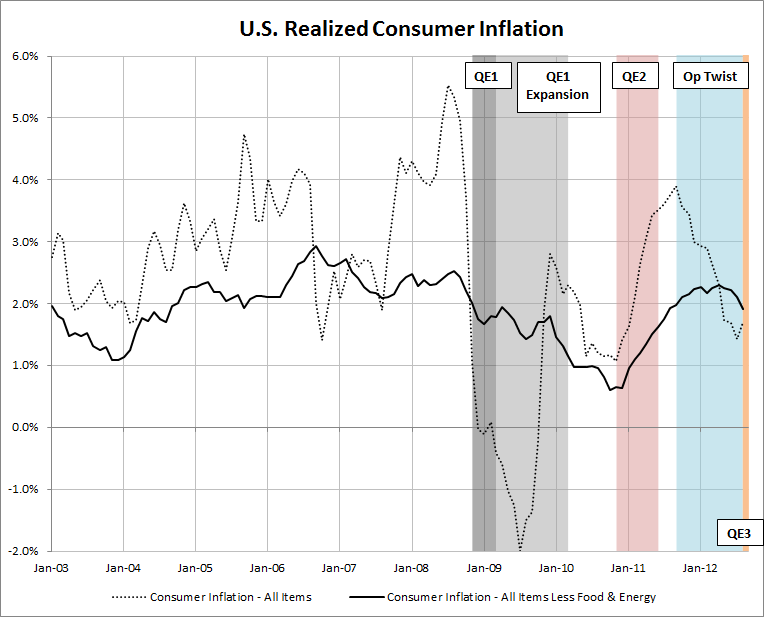

2. Core inflation, all consumer goods except food and energy, has fallen back below the year over year 2% level that the Federal Reserve likes to see.

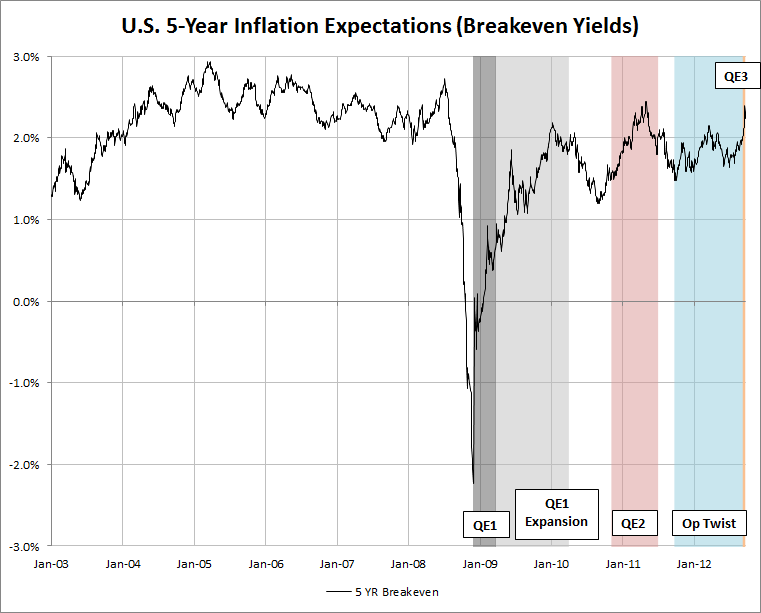

As QE 3 was anticipated and after it was announced, the expectation for inflation over the next five years is now about 2.25% per year. This rise above 2% occured during QE 1 and QE 2, only to fall back below 1.5% after each program was completed.

While prices have seemed to stabilized more recently, unemployment remains stubbornly high. The jobless rate, at this point it time appears to be a larger issue then the threat of sub 2% inflation for an extended period of time.