One of the sticking points of the debt ceiling talks in Washington D.C. has been the future of individual and corporate tax rates. Currently it is unclear whether or not tax rates will change. A strong argument can be made that revenues will need to increase in the future to pay down the $14.3 trillion debt of the United States.

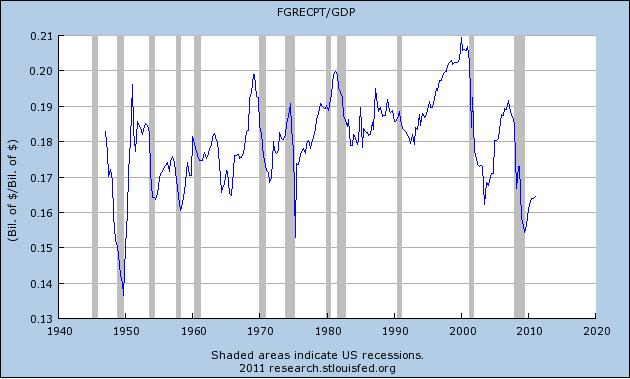

To gauge how much tax revenue has been collected, relative to the size of the economy, the chart belows divides total federal government receipts by gross domestic product (GDP). This provides an interesting historical perspective on federal revenue. During recessions this number plummets as less taxes are owed by individuals and corporations (higher unemployment and less profits). The last recession saw a draw down in the percentage to ~15.5%. This level had only been breached twice in the last 60 years prior to 2008-2009.

To reach the peak revenues collected would have to rise radically from this point. Previous peaks have occurred just prior to recessions. The highest rate ever achieved, ~21%, was during the waining years of the 1990s and the year 2000. Interestingly enough this is the the only time over the past 60 years that there was a federal budget surplus and the federal debt was paid down.

Federal Government Receipts as a Percentage of GDP