As any saver can bear witness to, current interest rates offered by savings accounts, certificates of deposit and United States Treasury bills are meager. For example, the interest rate of a 1 year United States Treasury bill dipped below 1% in December 2008 and has trended lower ever since. As of July13th the rate stands at a paltry 0.16%, a level not seen in over 60 years. While this rate is low, once inflation is factored in, the real yield is actually negative.

Investors with a significant allocation to fixed income securities are especially sensitive to what the real (inflation adjusted) rate of return that their portfolio is generating. Inflation will, over time, decrease the purchasing power of the interest income received from the investment.

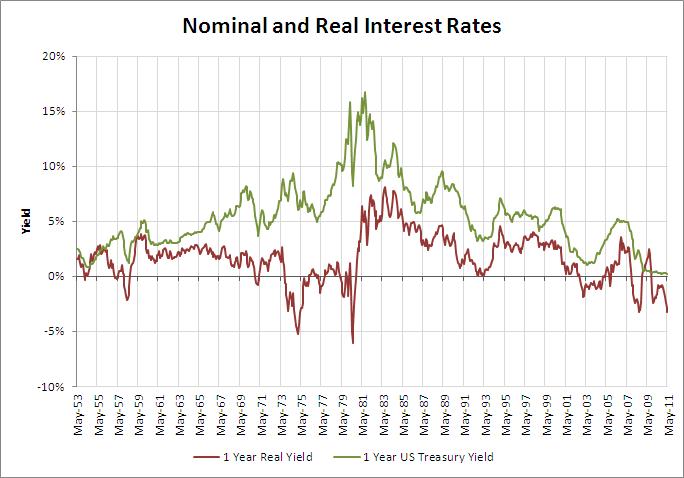

In the chart below the nominal (aka stated) yield of the 1 year US Treasury bill shows how interest rates have fluctuated since 1953. Over this time period the nominal rate has remained positive. For it to be negative, investors would be in effect paying the US government for the right to purchase 1 year US Treasury bond. Not a likely scenario!

The chart also illustrates that, after inflation is subtracted from the nominal interest rate, the resulting real interest rate is currently negative. This means that if one purchases a 1 year US Treasury Bill and holds it to maturity, the principle and interest recieved at the end of the holding period, while greater than the purchase price in nominal terms, is actually worth less than it was at purchase in real terms.