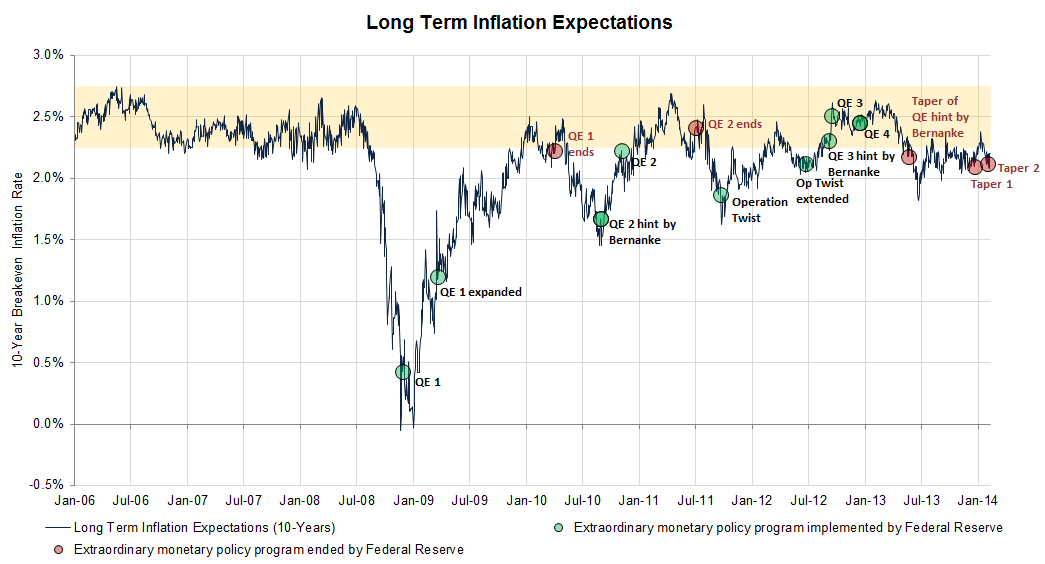

Market reaction to the numerous extraordinary U.S. Federal Reserve programs over the past five years has been fairly constant in regards to long term inflation projections. When the Fed has introduced or expanded a quantitative easing policy the market’s 10-year inflation projection has risen. Even “hints” at these programs have exacted a reaction from the market. As programs have come to a close or, more recently started winding down, long term inflation expectations have declined.

Prior to the 2008-2009 Great Recession 10-year inflation projections were consistently between 2.25% and 2.75%, a fairly healthy range. The chart below illustrates that last May, when Ben Bernanke indicated that the Fed might reduce the then $85 billion per month bond buying program, inflation projections fell. Since that time the long term inflation projections have been fairly steady, typically between 2% and 2.25%.

(click on the image for a large size)

Data Source: Federal Reserve Bank of St. Louis

Over the past two months the Fed has reduced the amount of bonds it buys per month. In December the Fed announced it would reduce purchases from $85 billion to $75 billion per month. Last month it continued the reduction, from $75 billion to $65 billion per month.

Part of the Federal Reserve’s mission is to promote stable prices (keeping inflation at a reasonable rate). Historically the institution has preferred a cushion of moderate inflation to prevent the ravages of deflation. It will be worth monitoring inflation expectations over the coming year as the Fed weighs whether or not to continue to taper its large bond buying program.