Keeping an Eye on European Sovereign Debt

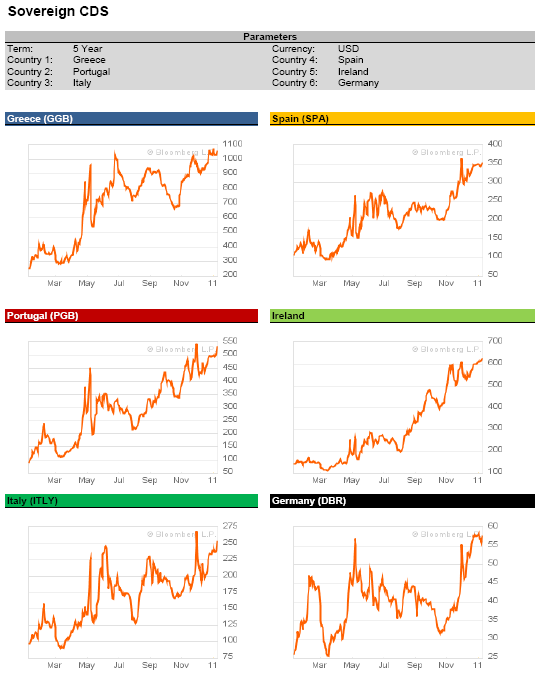

Over the past year, the cost of purchasing a credit default swap (CDS) to guard against the possibility of a sovereign European nation defaulting on it’s debt obligations has risen for most core European countries. A CDS can be purchased to provide credit protection on a bond that an investor already owns or used to speculate on the likelihood that a company or country will not be able to meet it’s debt obligations. The charts below list the spread, or annual amount that the buyer of a CDS must pay the seller, per every $10,000 worth of credit protection each year for the duration of the contract. For example, if the Greece spread was $1,000 at the time of the contract, each year the purchaser would owe the seller $1,000 per $10,000 of insured debt for a period of five years. If Greece than defaulted on the referenced debt, depending on the terms of the contract, either the seller of the CDS would owe the purchaser of the CDS protection the par value of the bond (physical settlement) or the difference between the par value and the market value of the debt obligation after default (cash settlement).

.

Both Greece an Ireland tapped the European-IMF rescue facility in 2010, which will provide loans to each of the countries at rates below what the market was willing to lend the countries, as they undergo budget cuts and attempt to use austerity measures to lower the overall debt burden of the nation. The reaction of the bond and CDS market to the plan of each nation to use the facility decreased the fear that a default by either nation was likely. However, the 5-year CDS for both Greece and Ireland are both approaching the record highs set in 2010.

.

A new source of increased risk in Europe has been Portugal. The country’s 5-year CDS has increased to a record of 552 as the nation prepares to issue new debt next week. The interest rate at which Portugal will have to issue this debt will provide a clue as to the likelihood that the nation will choose to use the European-IMF rescue facility.

.