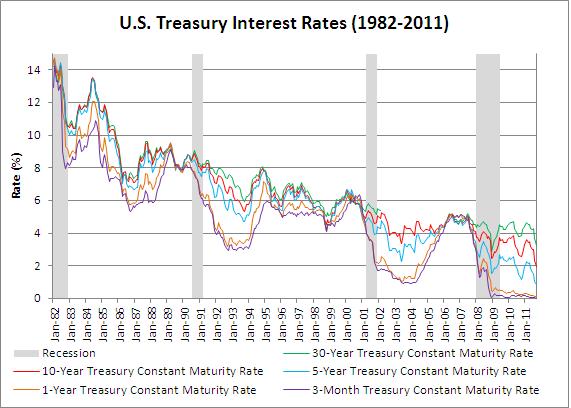

As every investor is acutely aware, interest rates in the United States have been unusually low for quite some time. The experience of the past few years has been in stark contrast to what investors have faced over the past 30 years.

Starting in the early 1980s interest rates in the United States began to trend lower. Periodically, typically a few years after the end of a recession, rates would increase as the economy began to expand. (All else equal, as economic growth increases there is a greater risk of inflation and investors demand more yield on their investment). However, high inflation, like that of the late 1970s and early 1980s, became less of an issue and the interest rates on U.S. Treasury bills, notes and bonds generally trended lower.

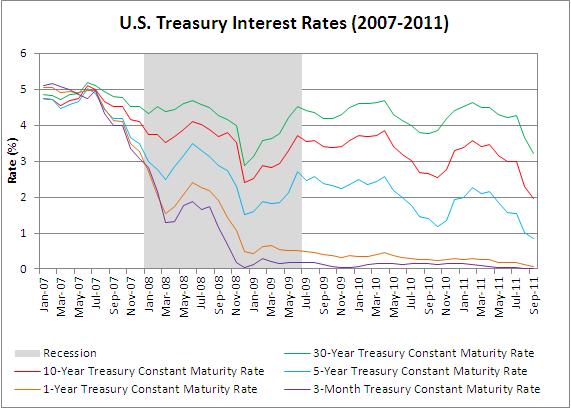

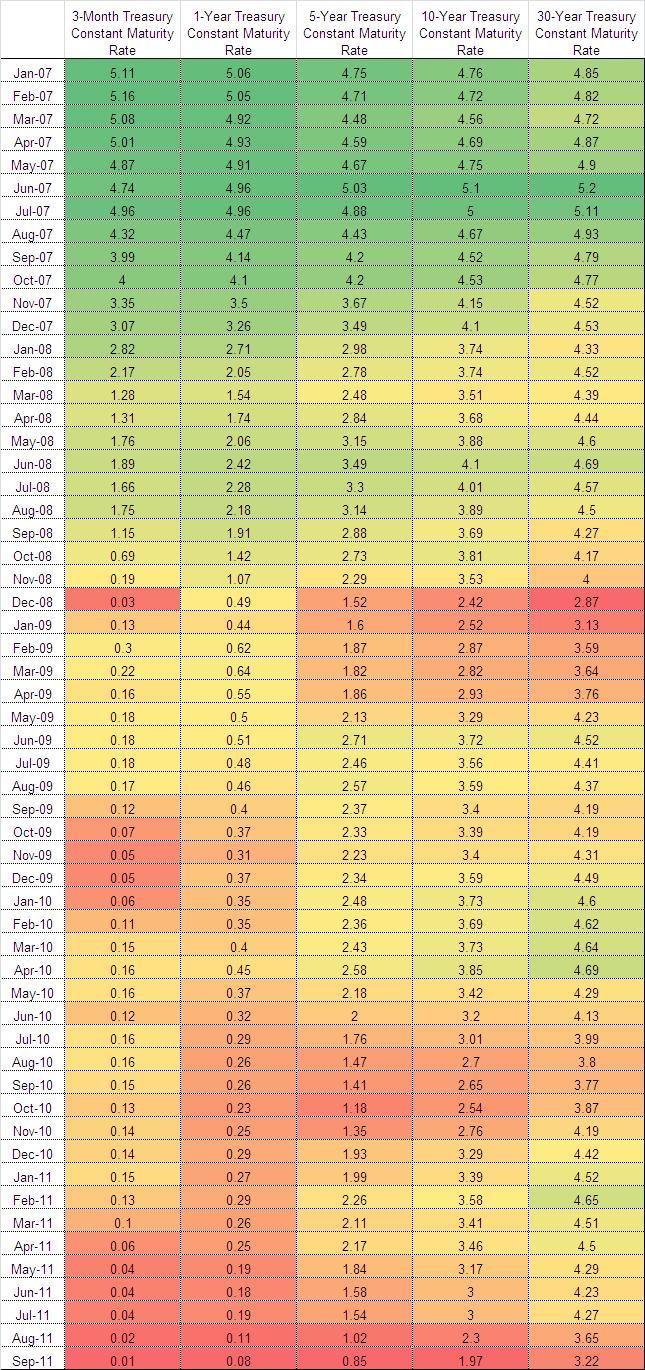

Today, some 26 months after the last recession ended, interest rates remain depressed. Apart from small ticks upward during the middle of 2009 and 2010, interest rates on nominal U.S. Treasury securities have continued to decline. This signals both a lack of fear of near term inflation by investors and a continued demand for U.S. Treasuries despite the record low rates and the August downgrade of the U.S.’s credit rating by Standard and Poor’s.

What truly sets the last few years apart from other post recessionary periods though has been the zero bound. Not since the 1930s have short term interest rates yielded so little. Today, all maturities a year or less have flirted with zero. As of Monday, September 19, the interest rate on the one year U.S. Treasury was 0.08%.

While those seeking credit might find low interest rates attractive when applying for a new loan, the saver is left with low yielding investment options.

Source: Federal Reserve Economic Data - St. Louis Fed