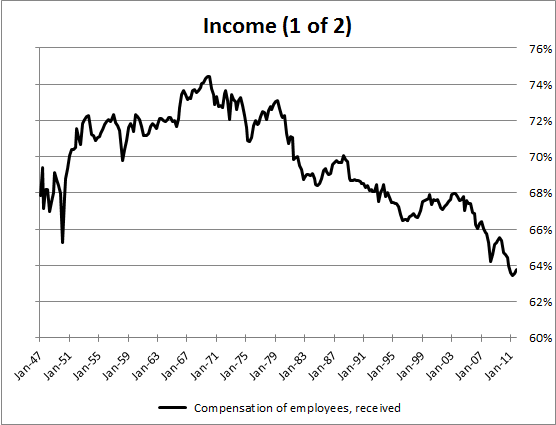

Over the past 65 years the amount of income received by Americans, as a whole, has generally increased over time. The source of this income, however, has varied a great deal. The variation speaks volumes about the underlying opportunities available to earn or receive different types of income in America. The sources of income might also play a large part in determining the pace of economic growth.

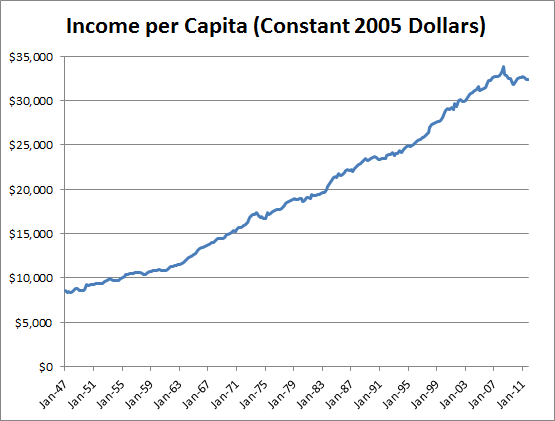

Today, the Bureau of Economic Analysis released the Q4 2011 Personal Income and its Disposition report. In the data lie clues as to the economic health of individuals in the U.S. and the potential of the U.S. consumer to drive future economic growth. With the onset of the Great Recession in 2007, income per capita plunged. While it has began to recover after the recession ended, it has yet to reach the previous peak.

While the total amount of income received certainly merits attention, the source of this income provides a deeper understanding of income in America. Over time the statistics read like a narrative and reflect how Americans historically have received income and what it has meant for the U.S. economy.

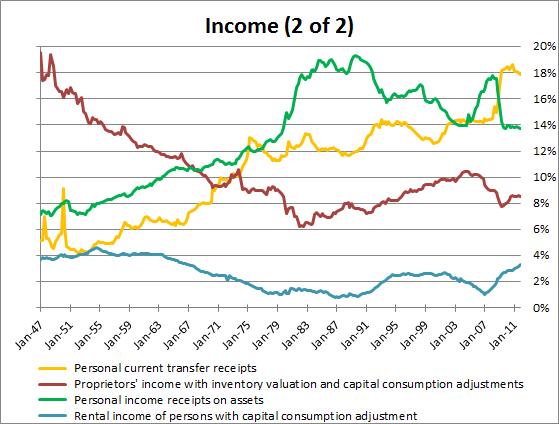

The first two income charts below reflect the source of American income as a whole. These charts illustrate that, since 1970 when income received via compensation for employment peaked around 74%, the income stream for Americans has broadened. The source of income for American citizens can be broken down into three distinct periods. Each era is defined by what the second largest stream of income is for individuals. (i.e. the highest point of any given year in the Income 2 of 2 chart.)

- 1947 – 1967 – Proprietor income. During the post World War II period, the U.S. economy went through a great boom and business owner income accounted for a great amount of overall American income. During this period small businesses still reigned supreme.

- 1968 – 2008 – Personal income on assets. During the first half of this period, income on assets was roughly in line with proprietor income and transfer receipts as the U.S. left the gold standard, went through a series of recessions (1969-1970, 1973-1975 and 1980-1982), and battled high inflation. Over the second half of the period, beginning in 1981, income on assets began to increase rapidly as a source of income. A reduction in income and capital gains taxes in the mid 1980s and booming capital markets were both responsible for the change in the degree to which Americans relied on income on assets.

- 2008-? –Current transfer receipts. Once the Great Recession hit at the tail end of 2007, transfer receipts became the second largest source of income for Americans. This occurred for multiple reasons. First, income on assets as a source decreased as interest rates plunged. Second, the front end of the baby boom generation began to draw on social programs such as Medicare and Social Security for the first time. Third, unemployment and other social programs that act as shock stabilizers during economic downturns kicked in.

Personal current transfer receipts, from above, broken apart into the six major sub components.