Using Consumer Expenditure Survey data from 1985 to 2005, generational attitudes regarding renting vs. owning can be observed. Furthermore, this data splits homeowners into two categories, those that carry a mortgage balance and those that do not. Ultimately one either rents, owns a home with a mortgage or owns a home and does not have a mortgage.

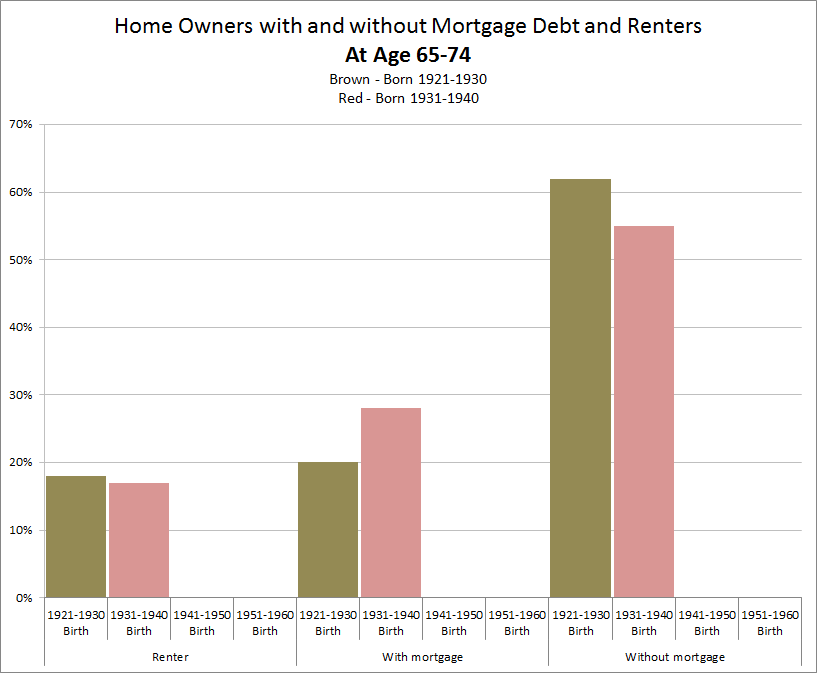

The number of people, between the age of 65 and 74, who owned a home and carried a mortgage balance increased dramaticly.

- People born between 1921 and 1930 were all between the ages 65-74 in 1995.

- People born between 1931 and 1940 were all between the ages of 65-74 in 2005.

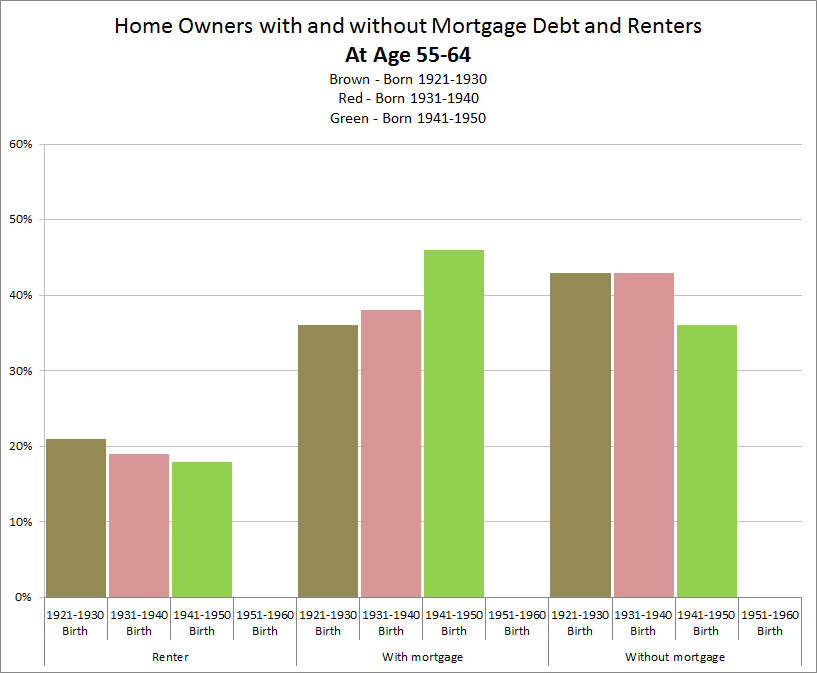

Perhaps the biggest generational change for home ownership was for people age 55-64.

- People born between 1921 and 1930 were all between the ages 55-64 in 1985.

- People born between 1931 and 1940 were all between the ages of 55-64 in 1995.

- People born between 1941 and 1950 were all between the ages of 55-64 in 2005.

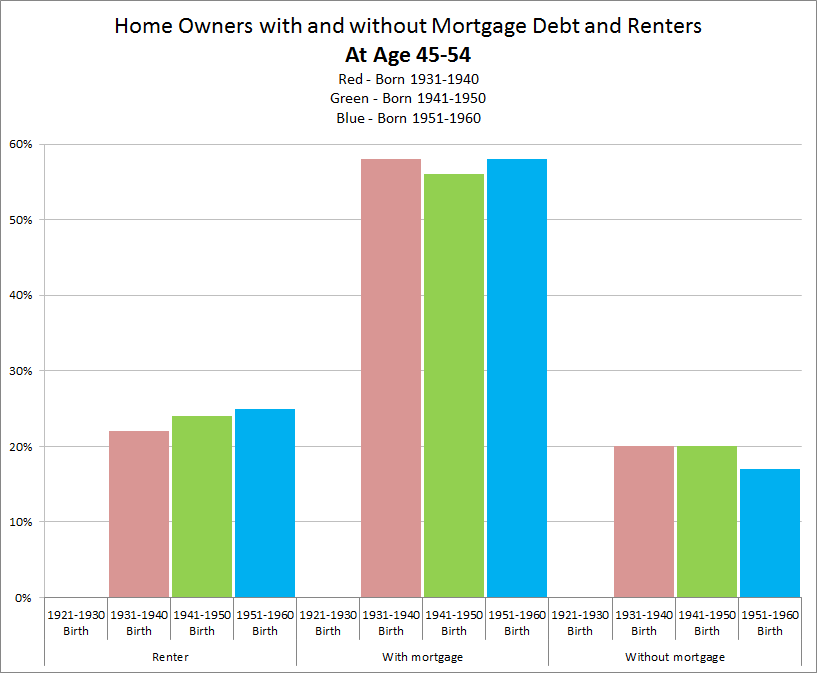

Parsing the data for people between the age of 44 and 54 illustrates that renting actually became more popular for each generation and that the number of homeowners with a mortgage did not change by nearly as much as the 55-64 age cohort or 65-74 age cohort did.

- People born between 1931 and 1940 were all between the ages of 45-54 in 1985.

- People born between 1941 and 1950 were all between the ages of 45-54 in 1995.

- People born between 1951 and 1960 were all between the ages of 45-54 in 2005.

While this data does not state the average amount of mortgage debt owed, the increase in the total number of families who had mortgage debt, especially for those age 55-64 and 65-75 provides a interesting perspective of the housing boom of the late 1990s and 2000s.

Data Source: U.S. Bureau of Labor Statistics