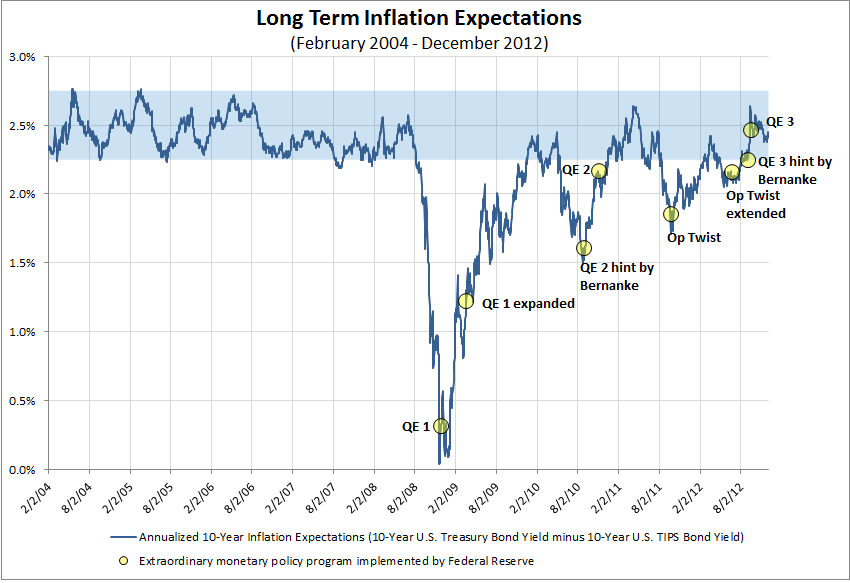

One way to gauge the markets expectations for inflation over the long term is to take the yield on the 10-year U.S. Treasury Bond and subtract the 10-year U.S. Treasury Inflation Protected Security (TIPS) bond yield. This difference (or spread) can be viewed as the expected inflation over the term of the bonds.

This spread can be viewed as such, because the U.S. is viewed as unlikely to default on its debt payments and there is a large liquid market for U.S. Treasuries, thus the yield of a U.S. Treasury bond is primarily a reflection of a third risk investors face; inflation. A U.S. TIPS bond adjusts for inflation and thus removes the inflation component from the security. The U.S. TIPS yield is commonly referred to as a real yield.

One of the U.S. Federal Reserve’s mandates is to promote stable prices (i.e. keep inflation to a moderate rate). From early 2004 to mid 2008, the annual rate of inflation, over ten years time, was expected to be between 2.25% and 2.75% (as implied by the spread between a nominal 10-year U.S. Treasury bond yield and 10-year U.S. TIPS yield). This can be interpreted as “normal” inflation.

By the end of the summer in 2008, 10-year inflation expectations plummeted. By the end of the year the market implied rate of inflation was close to 0% per year for the next 10-years. As the financial crisis raged on the U.S. Federal Reserve, with its mandate to keep price stable, and desperate to avoid widespread deflation, stepped in and introduced extraordinary monetary policy. It would not be the only time over the next four years.

These extraordinary policies are known as quantitative easing or QE for short.

(click on the image for a large size)

- QE1: The first extraordinary quantitative easing program (QE1) was announced on November 25, 2008 with the Fed promising to purchase $500 billion in Mortgage Backed Securities (MBS) and $100 billion of direct government sponsored entity (GSE) obligations – i.e. mortgages from Fannie Mae and Freddie Mac.

- QE1 was expanded March 2009 with the Fed stating it would buy an additional $750 billion of MBS, and $300 billion of long -term U.S. Treasury securities. QE 1 came to an end at the end of Q1 2010.

- QE2: Not satisfied that it had done enough to lower unemployment and provide price stability the Federal Reserve announced a second quantitative easing effort November 3, 2010 (QE2). The Fed stated that it would buy an additional $600 billion of U.S. Treasuries under this program. By June 30, 2011 the Fed completed its task.

- Operation Twist: Less than three months later the Fed announced that it would sell short term U.S. Treasuries and use the proceeds to purchase long term U.S. Treasuries. This became known as Operation Twist, as the intention was to lower longer term yields. By selling short term securities, yields would rise on the short end of the yield curve. Hence, the yield curve would undergo a twist.

- QE3: In early September 2012, the Federal Reserve declared that it felt that further extraordinary monetary easing was necessary to fulfill its mission – promote full employment and long term price stability. Ben Bernanke announced that not only would Operation Twist continue, but that the Fed would purchase $40 billion of mortgage-backed securities per month for as long as the Fed felt it was necessary. Unlike QE1 and QE2 which both had finite timelines, QE3 does not.

Before QE 3, every extraordinary monetary policy action was finite. There was an explicit size and life of each program stated at the launch. With the most recent QE action, however, the conclusion of the program is at the U.S. Federal Reserve’s discretion.

Today the annual 10-year inflation projections are with the bounds of the more stable economic period of 2004 to 2007. Over the last four years inflation expectations were able to achieve this “normal” range before, but failed to remain there as each QE program ended. The open ended nature of QE 3 may have allowed inflation expectations to normalize, but the question remains, what will happen when this policy is either reduced or removed?