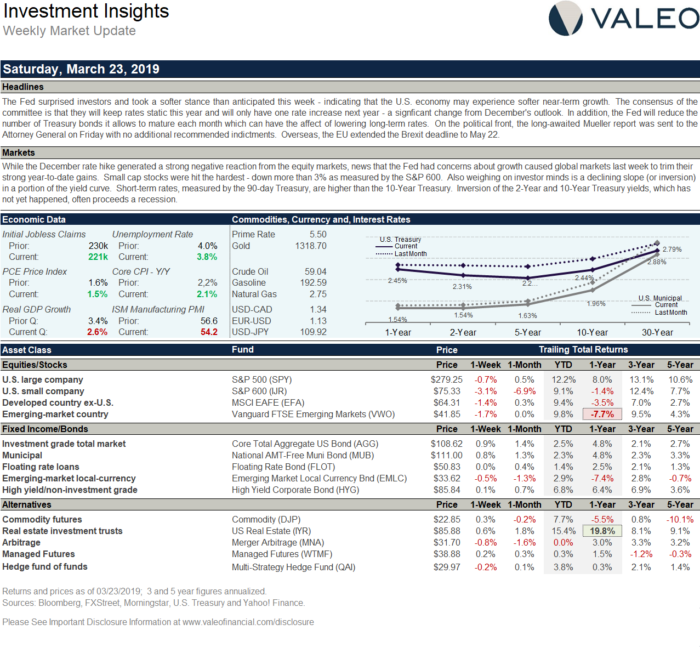

The Fed surprised investors and took a softer stance than anticipated this week – indicating that the U.S. economy may experience softer near-term growth. The consensus of the committee is that they will keep rates static this year and will only have one rate increase next year – a signficant change from December’s outlook. In addition, the Fed will reduce the number of Treasury bonds it allows to mature each month which can have the affect of lowering long-term rates. On the political front, the long-awaited Mueller report was sent to the Attorney General on Friday with no additional recommended indictments. Overseas, the EU extended the Brexit deadline to May 22.

While the December rate hike generated a strong negative reaction from the equity markets, news that the Fed had concerns about growth caused global markets last week to trim their strong year-to-date gains. Small cap stocks were hit the hardest – down more than 3% as measured by the S&P 600. Also weighing on investor minds is a declining slope (or inversion) in a portion of the yield curve. Short-term rates, measured by the 90-day Treasury, are higher than the 10-Year Treasury. Inversion of the 2-Year and 10-Year Treasury yields, which has not yet happened, often proceeds a recession.

Click on the image below for a larger view.