In a recent paper, the Federal Reserve took a look at how the Great Recession impacted family finances. The paper titled Surveying the Aftermath of the Storm: Changes in Family Finance from 2007 to 2009 compared the results from the 2007 survey of consumer finances with the answers from a 2009 follow up.

Although over 60 percent of families saw their wealth decline over the two-year period, a sizable fraction of households experienced gains in wealth, while some families’ financial situation changed little, at least on net. The shifts in wealth do not appear to be correlated in a simple way with families’ characteristics: instead, the pattern of mixed losses, gains, and modest shifts in wealth across families generally holds within groups defined by demographic characteristics.

On the whole, changes in wealth appear to stem from changes in asset values more so than changes in the composition of families’ portfolios or their outstanding debt, though, again, the results vary across households.

Changes in the level of debt, on the whole, did not drive the change in family net worth. During the credit crisis many families were not in a position to pay off debt and financial institutions were less willing to issue more. So, while one side of the ledger remained somewhat static, declining asset values drove the changes in family net worth.

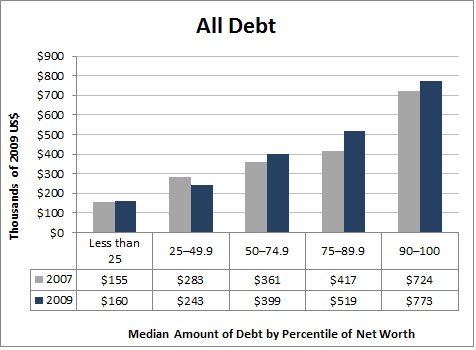

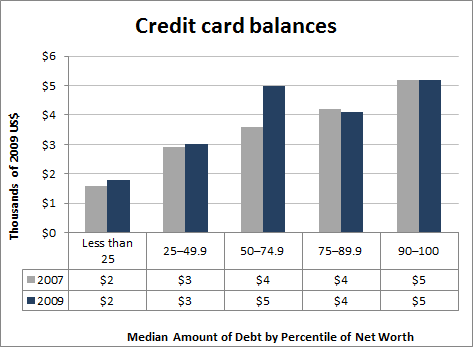

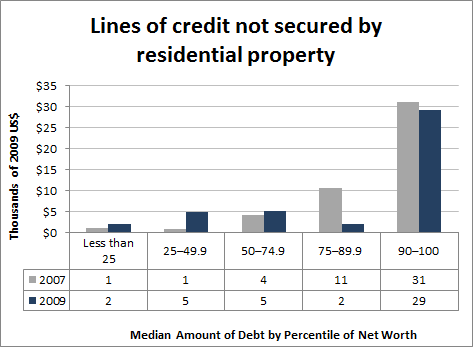

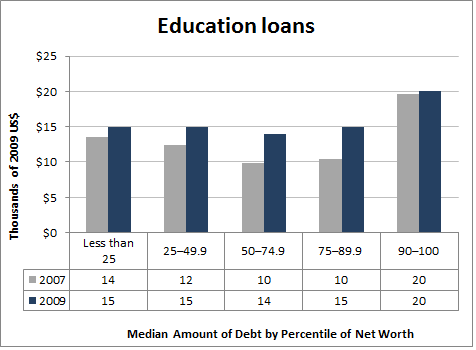

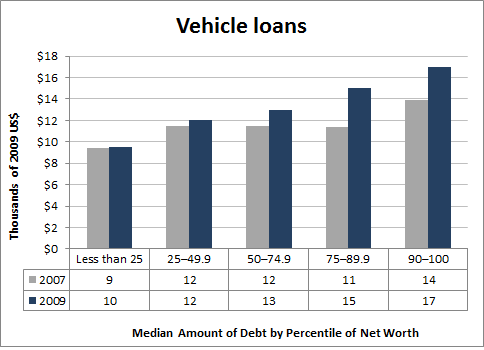

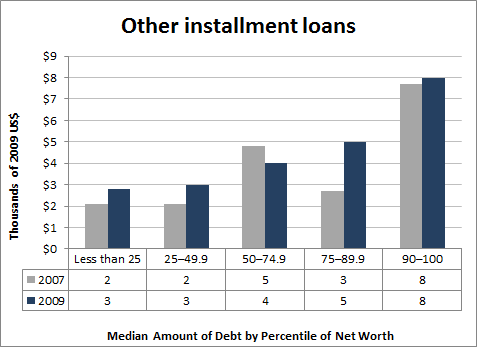

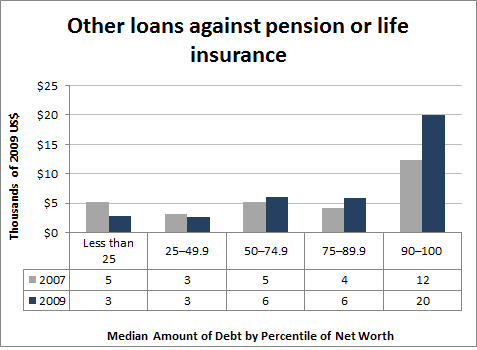

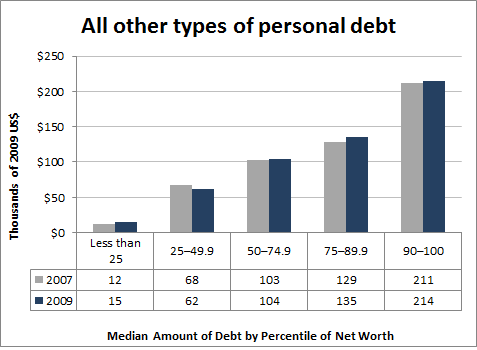

Segmenting the population by net worth and comparing the median amount of debt in 2007 to the median amount of debt in 2009 illustrates how much debt families, of a certain net worth, hold compared to other families of a similar net worth. Certainly some families would have shifted across the wealth distribution, but no matter which percentile of net worth a family was categorized as during 2007 or 2009 they are being compared to their “net worth peers.”

The median family net worth (half had more, half had less) was $125,400 in 2007 and $96,000 in 2009. During 2007 the 25th percentile of net worth was $15,500, the 75th percentile $388,600 and 90th percentile $969,400.

As a whole, the median amount of debt carried by families who were in the 25-49.9 percentile of net worth in 2009 was $243,000. This was less than the median amount of debt carried by families who were in the 25-49.9 percentile in 2007, when the amount was $283,000. The median amount of debt increased for all other net worth segments.

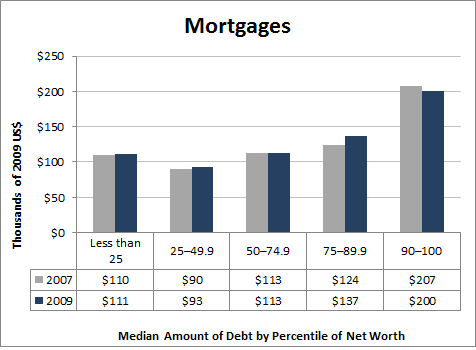

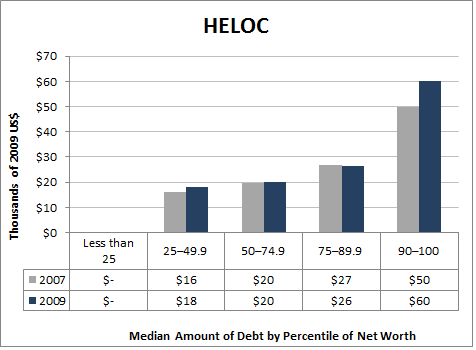

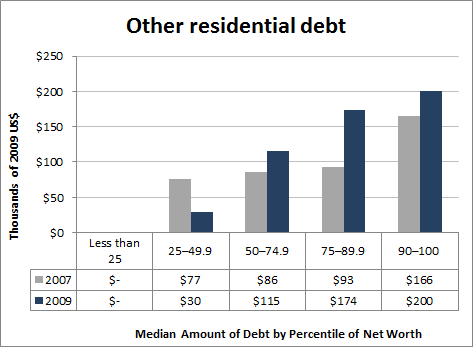

The study broke apart debt into ten separate categories. The charts below illustrate the changes in the median amount of debt for each segment of net worth. Just like total debt outstanding, the median amount of debt rose for some net worth segments and declined in others.