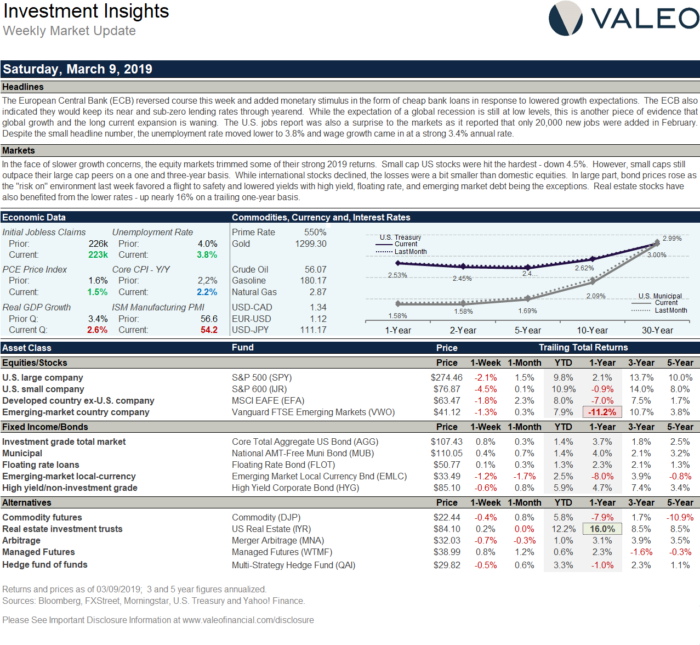

The European Central Bank (ECB) reversed course this week and added monetary stimulus in the form of cheap bank loans in response to lowered growth expectations. The ECB also indicated they would keep its near and sub-zero lending rates through yearend. While the expectation of a global recession is still at low levels, this is another piece of evidence that global growth and the long current expansion is waning. The U.S. jobs report was also a surprise to the markets as it reported that only 20,000 new jobs were added in February. Despite the small headline number, the unemployment rate moved lower to 3.8% and wage growth came in at a strong 3.4% annual rate.

In the face of slower growth concerns, the equity markets trimmed some of their strong 2019 returns. Small cap US stocks were hit the hardest – down 4.5%. However, small caps still outpace their large cap peers on a one and three-year basis. While international stocks declined, the losses were a bit smaller than domestic equities. In large part, bond prices rose as the “risk on” environment last week favored a flight to safety and lowered yields with high yield, floating rate, and emerging market debt being the exceptions. Real estate stocks have also benefited from the lower rates – up nearly 16% on a trailing one-year basis.

Click the image below for a larger view.