This week the focus by economists was on how much the United States economy grew during the second quarter. The consensus estimate was that the economy grew by an annualized 1.0%. The release by the U.S. Bureau of Economic Analysis, on Wednesday, surprised many by stating that the economy grew by 1.7% on an annualized basis. This advanced figure of 1.7% is subject to revision over the next two months as 2nd quarter economic data is finalized.

After the U.S. economy grew by an annualized rate of 1.1% during the first quarter and an annualized rate of 1.7% in the second, it is fair to say that slow U.S. economic growth continues to be the norm.

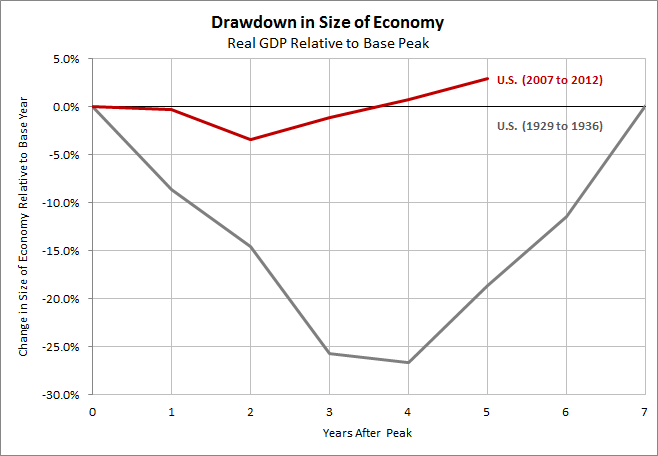

Continuing on the theme from a blog post two weeks ago, that compared the U.S. Great Recession to the U.S. Great Depression, how does the U.S. economic growth since the end of 2007 compare to the 1929 peak, just prior to the Great Depression?

At the end of 2012, five years after the 2007 peak, the U.S. economy was 2.9% larger. Five years after the Great Depression began the U.S. economy was 18.7% smaller than it was in 1929.

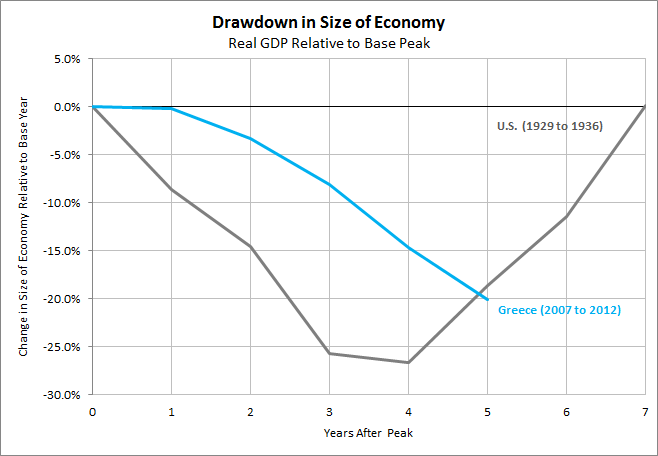

A unique factor of the Great Recession of 2008 and 2009 was just how global in nature it was. One of the harder hit nations was Greece.

The chart below illustrates the draw down in the Greek economy during the past five years, relative to the U.S. Great Depression of the 1930s. The Greek economy has been shrinking since its 2007 peak and is now approaching the draw down that the U.S. experienced during the Great Depression of the 1930s.

Data Sources: U.S. Department of Commerce: Bureau of Economic Analysis and OECD Main Economic Indicators - complete database