The recently released Household Debt and Credit report by the Federal Reserve Bank of New York provides an interesting update on consumer credit conditions in the United States.

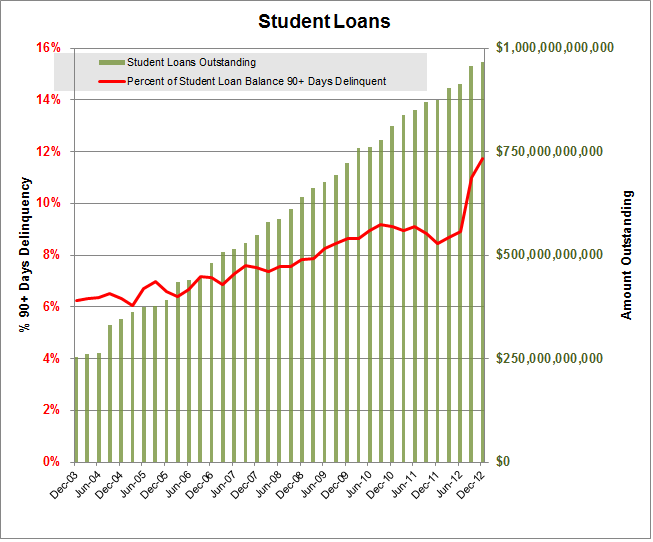

Outstanding student loan debt has nearly quadrupled since the end of 2003 and today stands at nearly $1 trillion. While the historical 90+ day delinquency on student loans since 2003 was between six and nine percent it climbed to 11.7% at the end of last year.

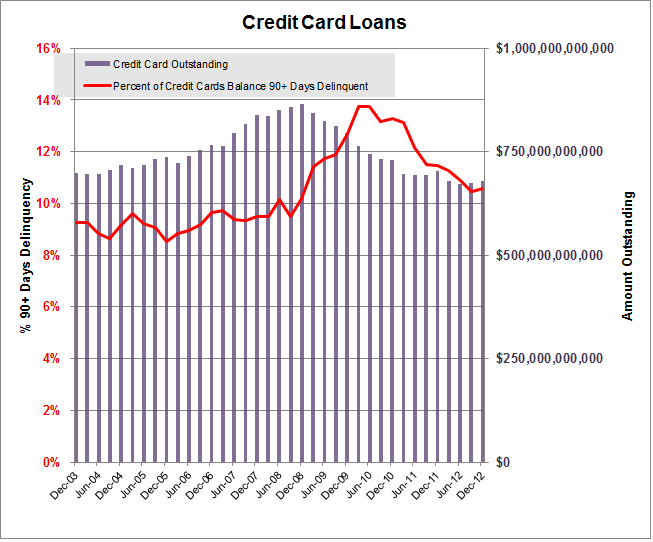

The amount of credit card debt outstanding peaked at the end of 2008 with the 90+ day delinquency rate reaching a high of 13.3% two years later. Though the 90+ day delinquent rate has fallen since it is not yet to the pre-recessionary 9-10% range. The amount of credit card debt outstanding remains hundreds of billions of dollars less than it did during 2008.

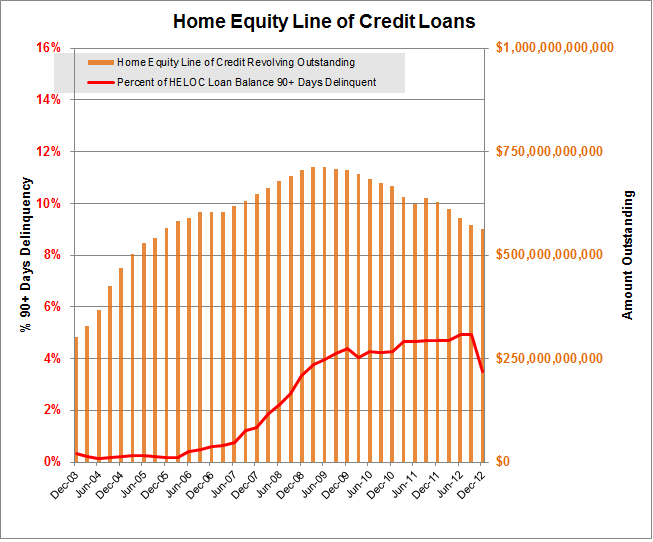

Home equity line of credit loans nearly trebled from 2003 to 2009. While the 90+ day delinquent rate was very low from 2003 to 2006, it picked up speed in 2007 and remained around 5% from 2009-2011. Recently the rate has fallen to below 4%.

The total balance of auto loans in the United States has remained the most stable of the four consumer credit components in this post, though there was a dip in 2009. The amount outstanding has since risen to pre-recessionary levels, however the 90+ day delinquency rate remains at levels nearly double that of pre-2008.

Data Source: Federal Reserve Bank of New York