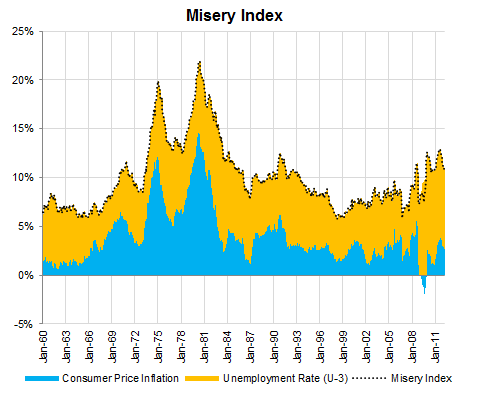

A simple way to gauge the collective mood of the American consumer is to add consumer price inflation to the unemployment rate. This measure is known as the misery index. Both a high level of inflation and unemployment have an adverse economic impact on the economy.

During recessions the misery index tends to rise. This makes logical sense as unemployment tends to rise and the pace of inflation usually does not decline as quickly.

The recession from December 2007 to June 2009 is a bit unique as compared to recessions since 1960 because, this time, the unemployment rate was the primary driver of the index. In fact consumer price actually fell in early 2009. This is dramatic contrast to the recession in the 1970s and early 1980s when inflation was in the double digits.

As of March 2012 the misery index stands at 10.85%. The current unemployment rate is 8.20% and consumer price inflation is 2.65%. Surprisingly, the recent peak of the misery index of 12.90% occured not during the Great Recession at the end of the last decade but last September. With an elevated (all be it declining) unemployment rate of 9.00% during September 2011 and a return of consumer price inflation of 3.90%, the index rose to the highest level since the early 1980s.

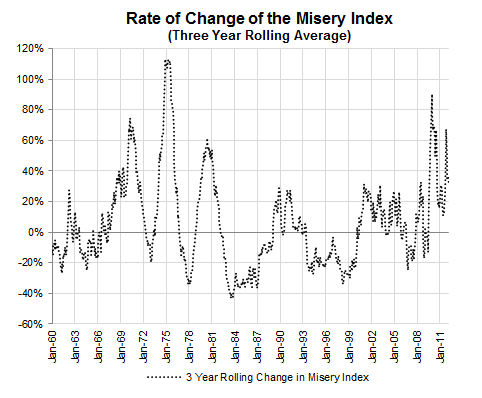

The second chart illustrates the pace of change in the misery index over a three year period. For example, in March 2012 the index was 30.9% higher than it was in March 2009.