As 2013 comes to a close, here is a look back at important domestic economic themes. (Click any image for a larger view).

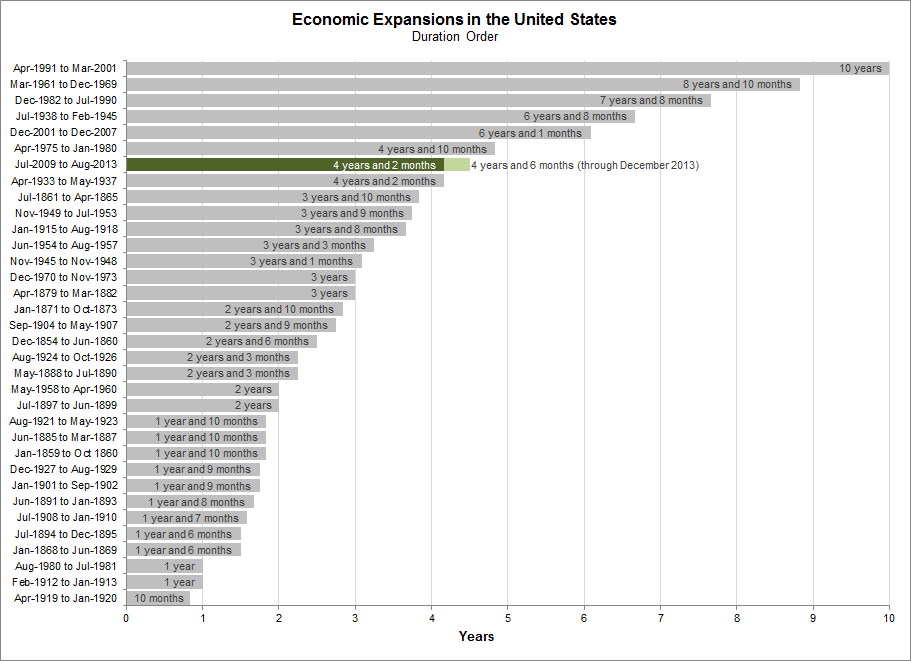

The U.S. economy continues to expand at a moderate pace. The country has now experienced the seventh longest recession free period since at least 1859.

Full Post: Uninterrupted Growth

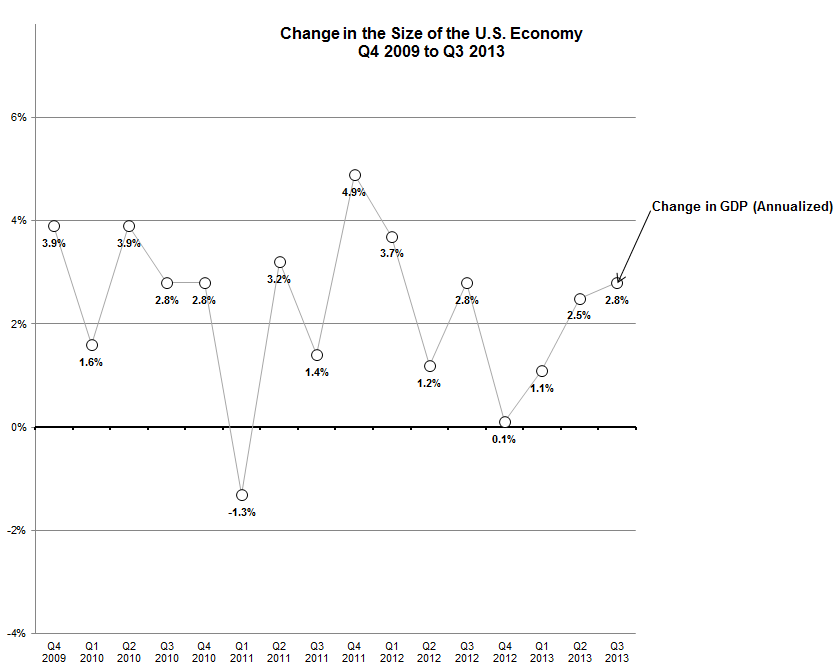

Q3 2013 growth has since been revised to 4.1% from the initial government estimate of 2.8%.

Full Post: What is Driving Growth in the United States?

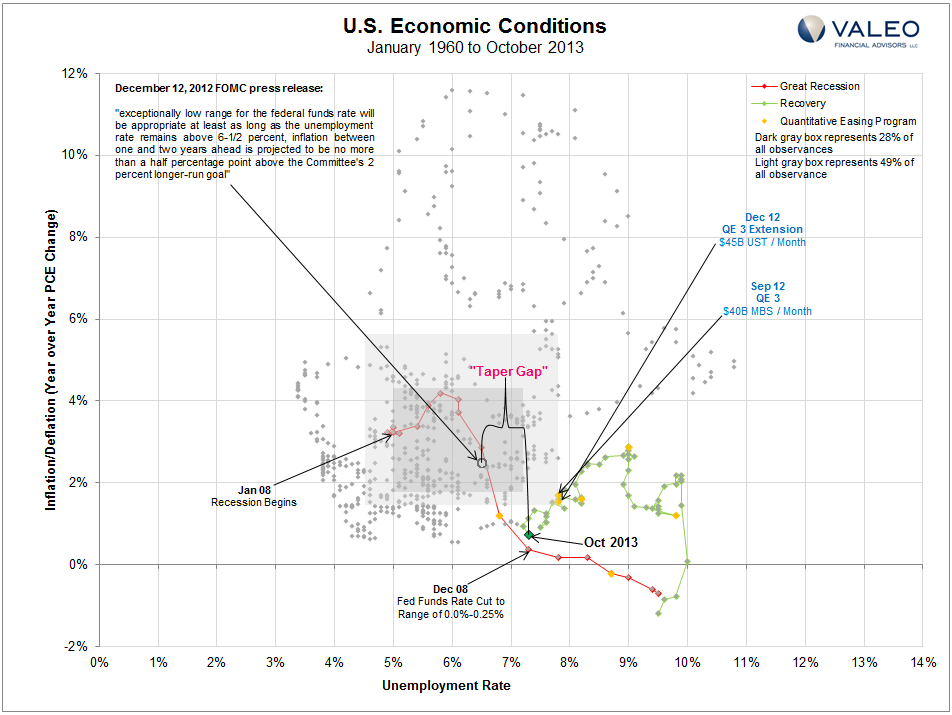

Growth has been moderate, inflation in check and the unemployment rate has declined. This lead to the U.S. Federal Reserve reducing (tapering) the amount of bonds it buys each month to stimulate the economy.

Full Posts: The U.S. Economy, Inching Closer to Normality and The Fed: Thinking Outside the Box (with Video)

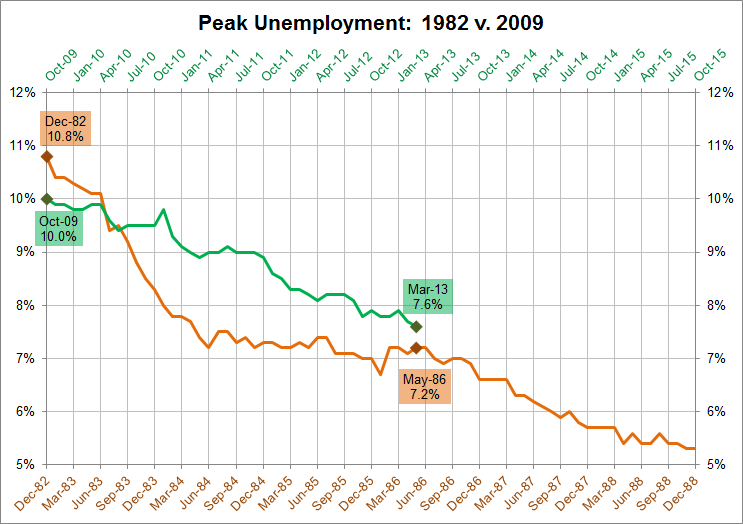

Unemployment has declined and, as of November, the unemployment rate stands at 7.0%.

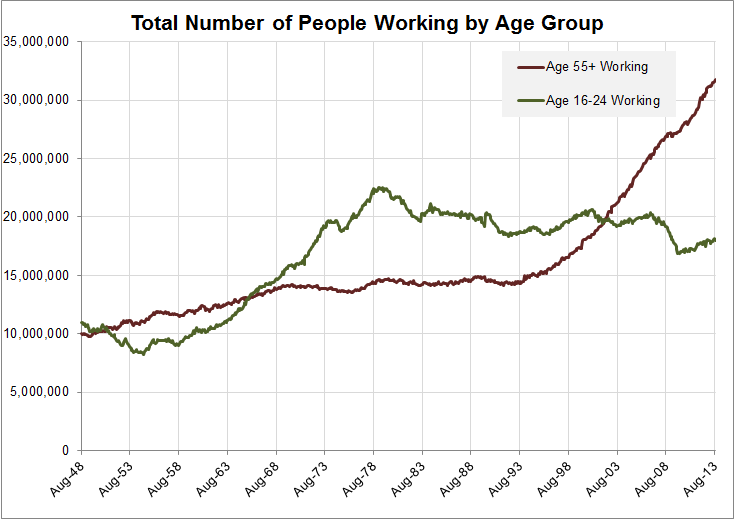

The makeup of the employed has changed over the last decade.

Full Post: Unemployment in America – Past and Present

Full Post: Employment at Age 55+ is Greater Than Age 16-24

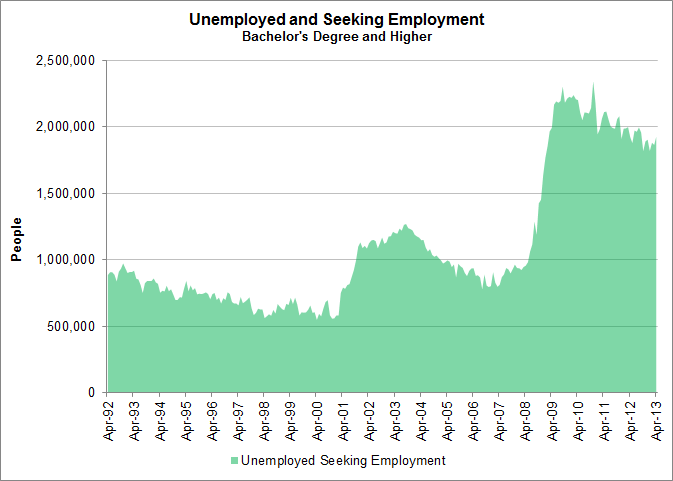

Full Post: Employment in the U.S. for Individuals with a Bachelor’s Degree and Higher

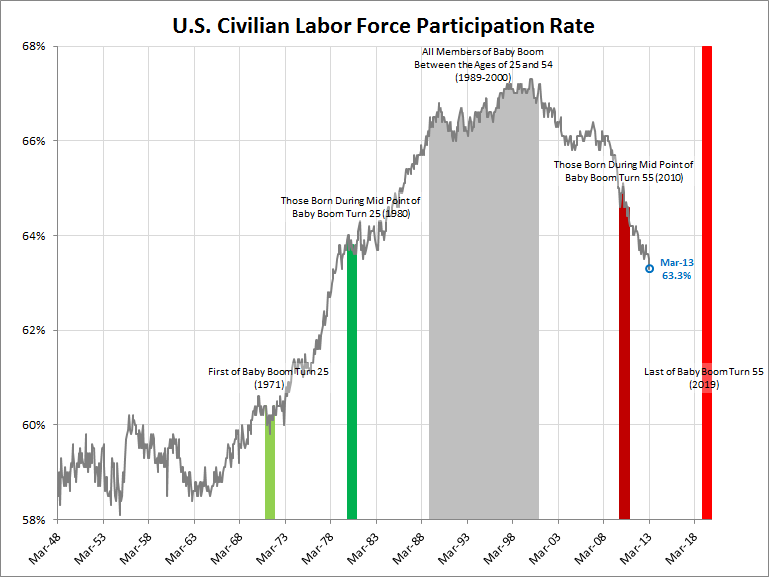

Full Post: Labor Participation and the Baby Boom

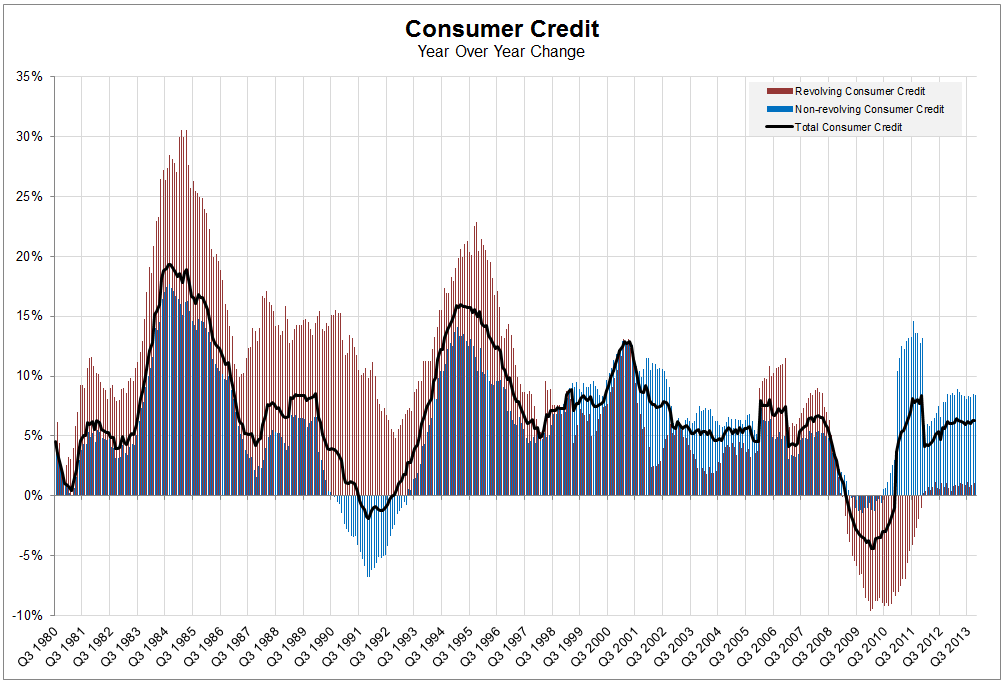

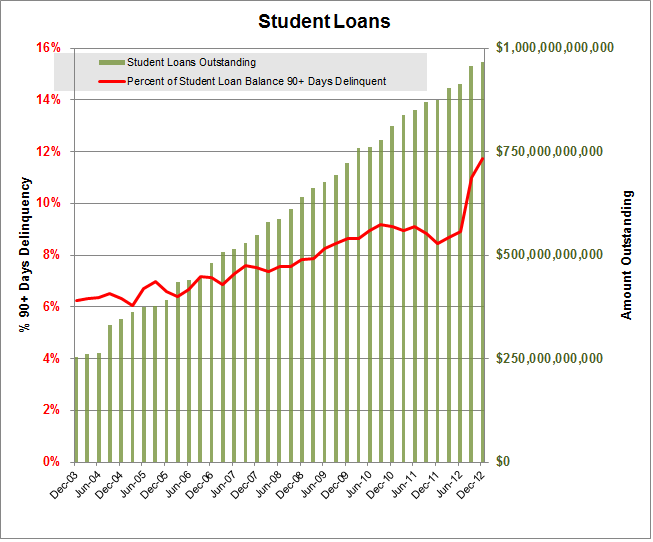

Consumer credit bounced back, but it was mostly due to increases in non-revolving credit, i.e. student loans and autos.

Full Post: What is Driving the Expansion in Consumer Credit?

Full Post: Consumer Credit Check Up

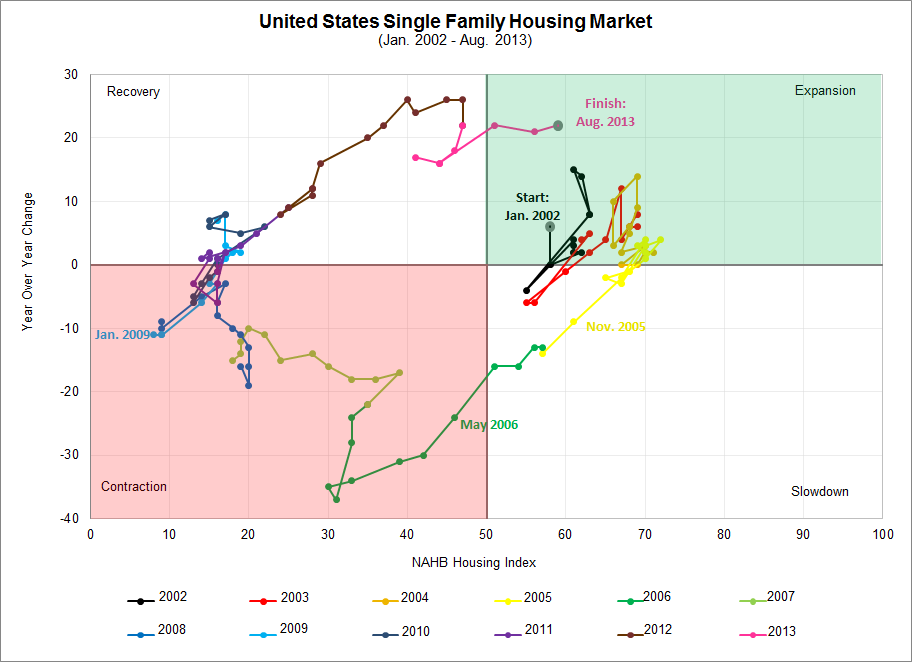

Over the course of the year, housing in the United States moved from the recovery stage to expansion.

Full Post: A Round Trip in Single Family Housing